After the trial balances have been imported from source systems, for all the subsidiaries and affiliates, we can trigger the automated process of SAP data preparation for consolidation purposes. In this brief blog, I will describe the few steps that are automated by the system to ensure that the data is comprehensive and will be ready for consolidation.

When the trial balances are uploaded from the source systems, whether periodic or YTD in their nature, they would have to balance, whereas the total assets, liabilities, equity, revenues, and expenses will add up to zero. However, reporting the financial statements requires abiding by some financial reporting rules.

This step will include the most basic and required rules to ensure consolidation works, but further steps can be added in this automation.

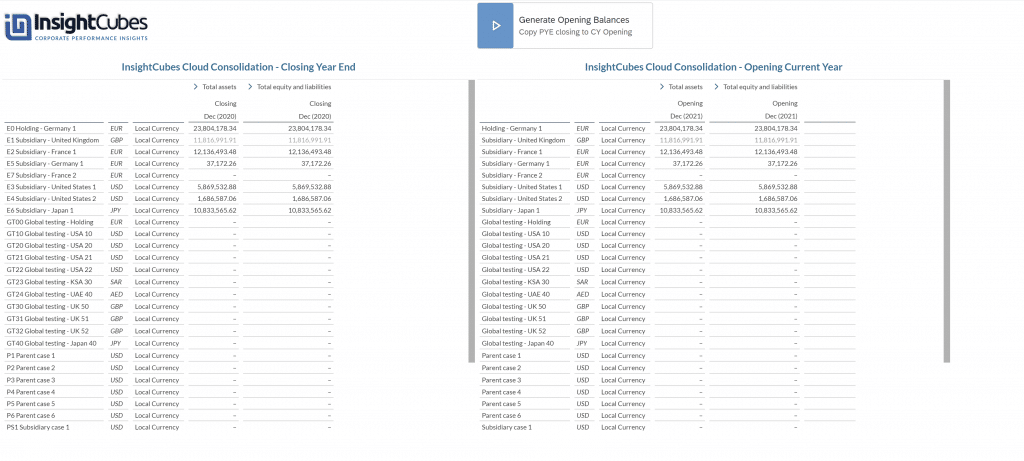

The first activity that this process will conduct is to generate the opening balance for each account in the balance sheet, by taking the YE closing balance of the prior year and posting it on the opening flow of this year. This activity will be done when YTD values are uploaded from the source system and the data is persisted as YTD in the measure.

If the source system has periodic values, we NEED to persist the YTD values in the measure by converting into YTD, which is also automated in this process. The system is designed to allow us to identify which companies are providing their Balance Sheet in periodic values and which are doing so in YTD.

Harmonizing the data is a fundamental step that is required, whether we need to persist in YTD or Periodic, but the rule dictates that the data is harmonized across all. so if the storage method is YTD and some companies report in periodic, the system will convert to YTD and store, and if the storage method is Periodic and the entity provides in YTD, conversion to periodic is applied. Subsequently, the opening balances are influenced, whereas periodic opening will be prior month’s closing, whereas YTD opening will be the prior year’s closing.

Keep in mind that reporting in any measure (YTD, Periodic, QTD and Trailing twelve months) is all available, regardless of how the data is stored.

Going forward in this blog, we will consider that the Trial Balance values, for all the companies, will be stored in YTD (also note that we can have YTD balance sheet with PERIODIC Profit and Loss, which also has a native method of handling, but will not be covered here).

After generating the opening balances per account, the system will calculate the net income per entity and allocate the value to the retained earnings flow named net Income for the period. Alternatively, the value can be allocated to current year’s earnings in the balance sheet, which would be added to retained earnings opening balance by year-end. These were the financial reporting requirements for some companies that adopted the solution; a minor deviation requiring a line or so of additional code.

The last action that the system will carry will be the calculation of the variance between opening and movement with the closing. The difference will be stored in a specific flow per each balance sheet account. “in memory” calculation is not possible, since these values should be picked up by the currency translation logic and consolidation logic, which will be explained in subsequent blogs.

Now, you have learned the SAP Data Preparation process for our designer.