Overview and Purpose of Journals in SAP Analytics Cloud

Journals play a crucial role in financial consolidation, ensuring accurate adjustments and compliance with reporting standards. Journals provide a structured approach to recording adjustments, allowing organizations to refine financial statements with precision. By enabling targeted modifications at a specific entity or consolidated level, journals help maintain data integrity, streamline reconciliation, and ensure transparency in financial reporting. Equally important, the ability to create, manage, and control journal entries enhances financial governance, making them an essential component of a robust consolidation framework.

Understanding Journal Entries in the Consolidation Extension for SAC

Users with journal entry rights can create and manage journals with unique IDs, allowing them to enter adjustments directly into debit and credit fields. When entering journals, users can select specific audit trail members, which determine whether the journal will undergo currency conversion, be included in consolidation, or be affected by other logic.

Journals can be applied at an entity level or as top-line adjustments on consolidated balances, with entries made manually or uploaded from an Excel file.

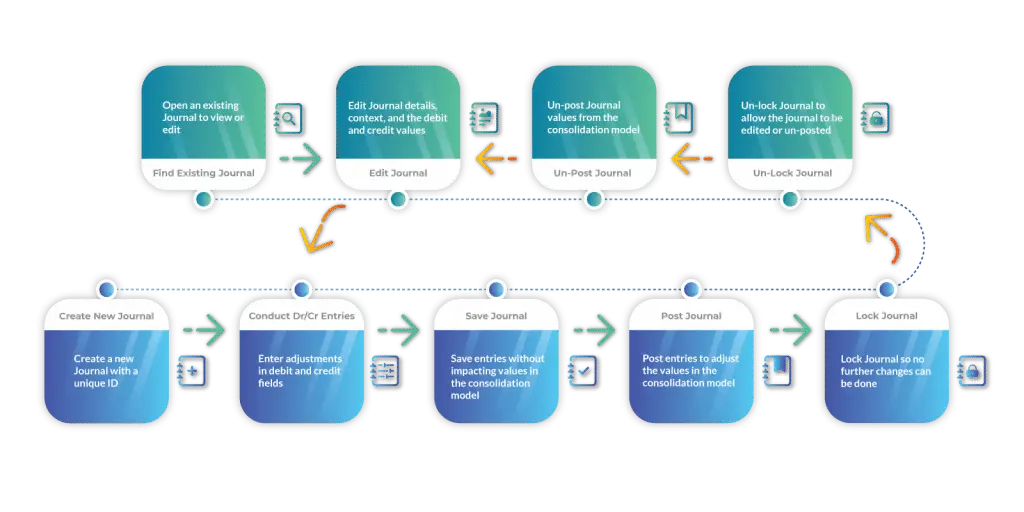

Users have full control over their journal entries, including the ability to save, post, edit, un-post, lock, unlock, and delete them, ensuring accurate financial management across subsidiaries and their holding companies.

Types of Journals

Users can create different types of journal entries to address various scenarios during the consolidation process. While our Consolidation Extension for SAP Analytics Cloud (SAC) automates most eliminations and adjustments, there are instances where manual one-time entries are necessary. Journals serve this purpose.

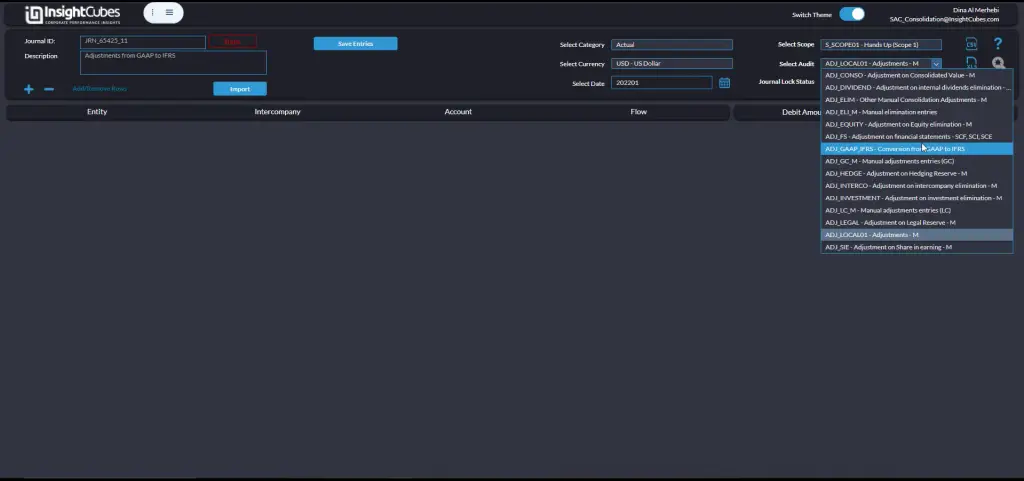

Currency and Consolidation rules

Journal entries may involve currency conversion if entered at a specific entity level in local currency, or they might be recorded directly in the reporting currency. Some entries are subject to consolidation rules when made at an entity level, while others function as top-line entries in group currency. Such treatment of these entries during the consolidation process is determined by the selected audit trail members, which govern the rules applied to the values.

Additionally, audit trail members dictate whether journals are carried forward to the next year’s opening balances or not.

Furthermore, journal governance is crucial, linking roles and authorizations to ensure control over the process. Our Consolidation Extension for SAC allows differentiation between users who can create journal entries and those who can post them, following approval.

Lastly, granular permissions can be set to determine who can edit, un-post, or unlock journals, ensuring proper oversight and security throughout the process.

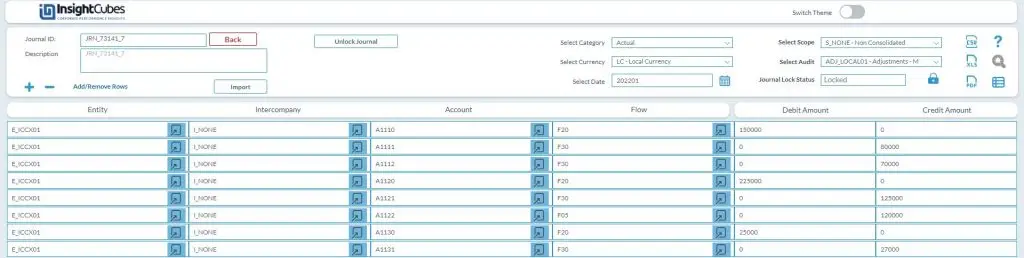

Introducing New Design and Theme Options!

Announcing a major update to all our dashboards! We’ve undergone a comprehensive design revamp, bringing a fresh, modern look and feel to enhance your user experience.

Now you can easily toggle between themes based on your visual preference or ambient lighting, ensuring optimal readability and comfort.

Creating new Journal entries

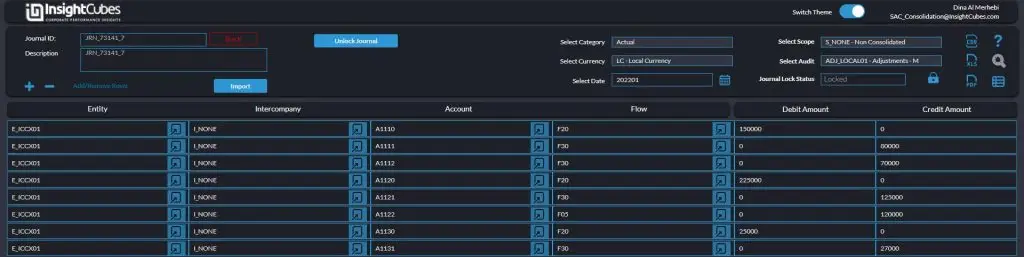

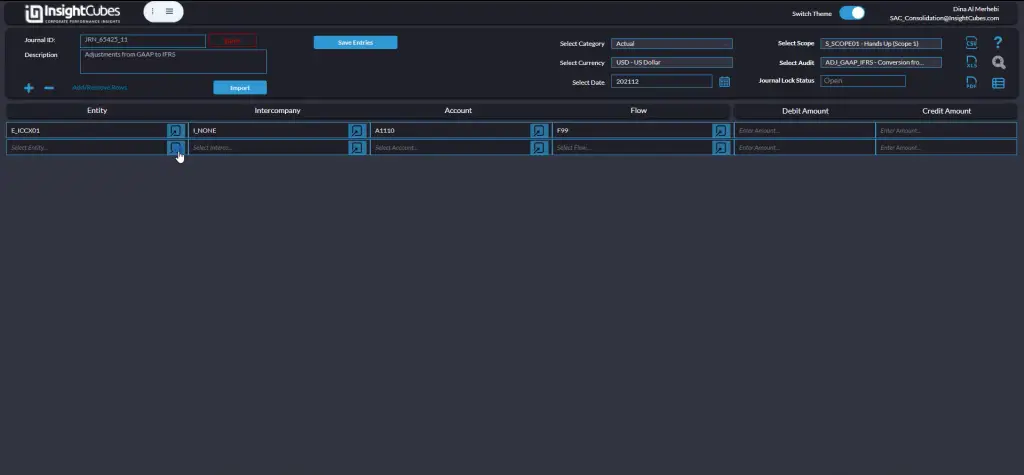

Provide a journal description and adjust the context using the dimension dropdowns.

Enter a unique description and select all intersections you want to save data records on from the dimensions dropdowns:

- Version (actual, budget, plan, or forecast)

- Currency (reporting or local)

- Define the scope (impacting consolidation or standalone)

- Determine the adjustment type under audit

- Finally, specify the date (year and month) for your journal

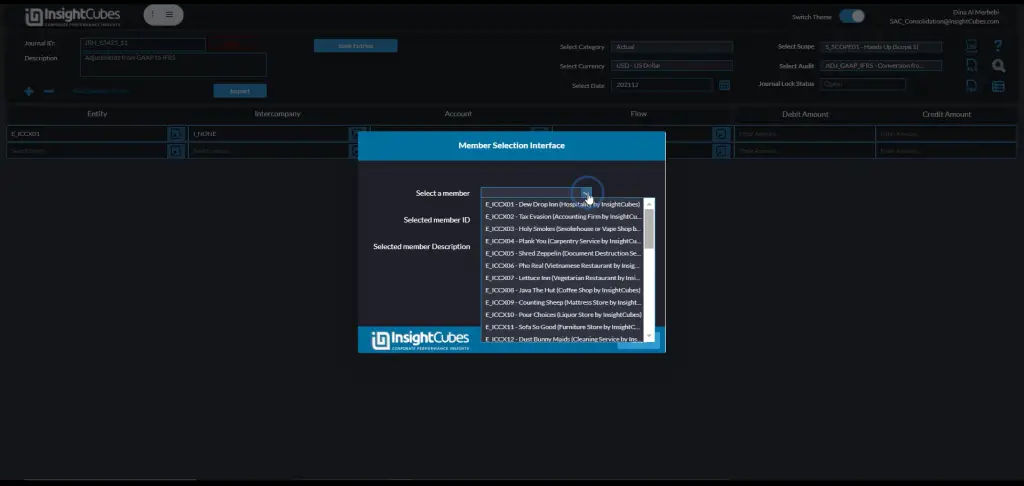

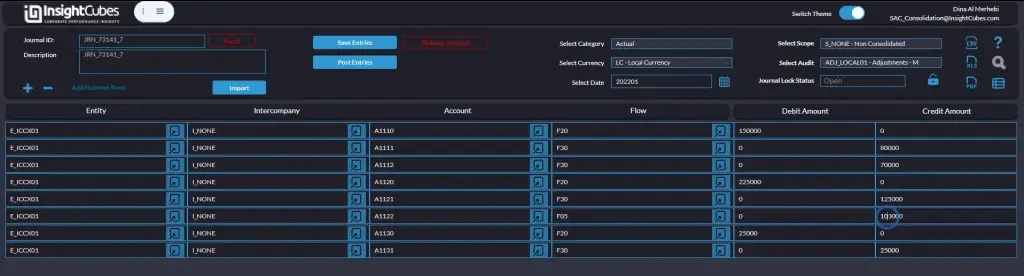

Click the plus sign to add a row, then fill in the cells either manually, using the member ID if known, or by selecting members from the dimension popups.

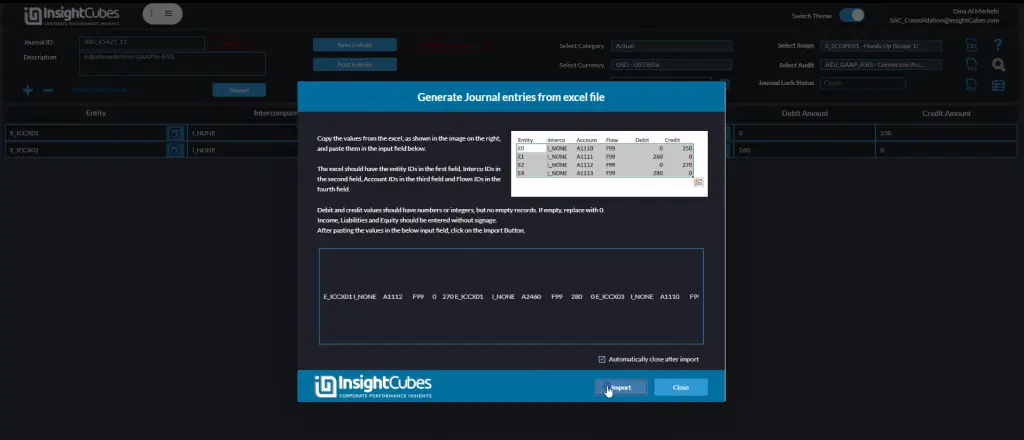

Mass data entry

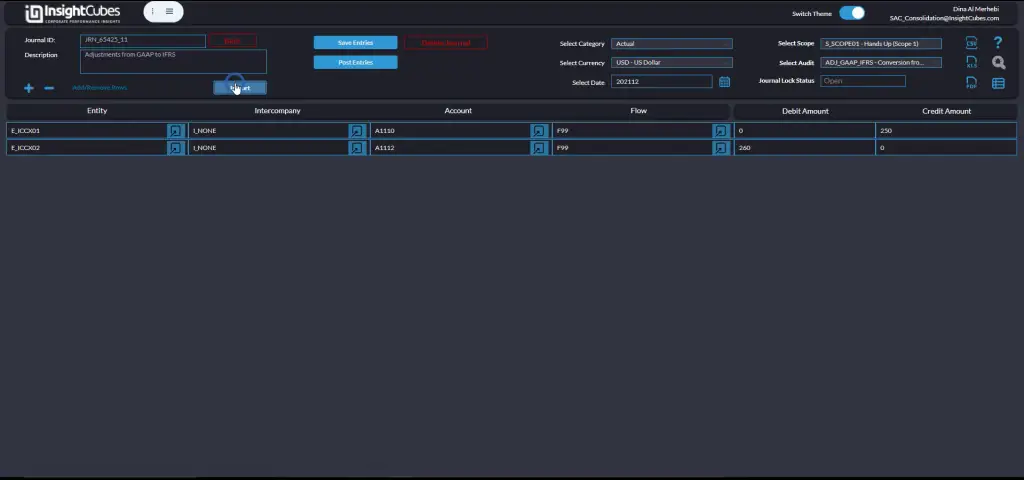

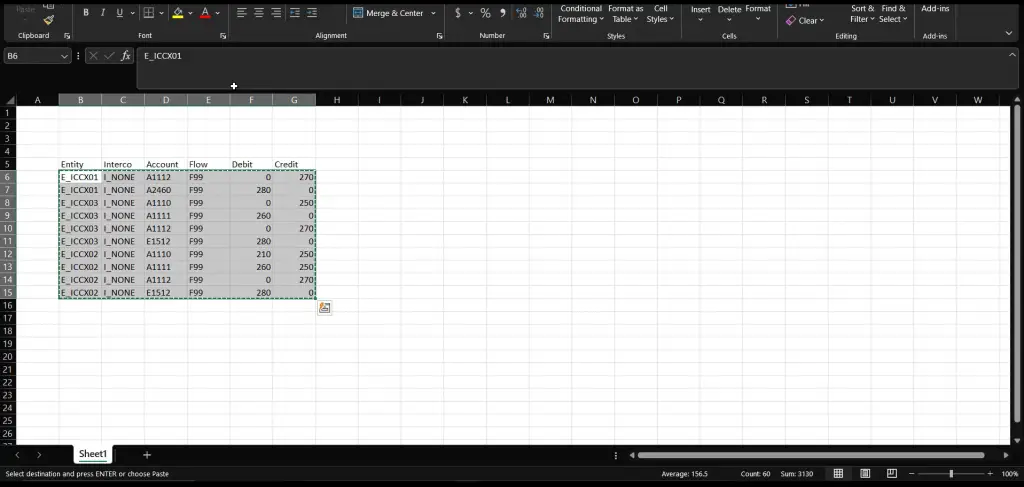

Alternatively, you can conduct a mass upload of Journal entries from Excel.

Simply click the “Import” button, paste your Excel data into the provided input field, and then click “Import” to efficiently create all the journal entries at once.

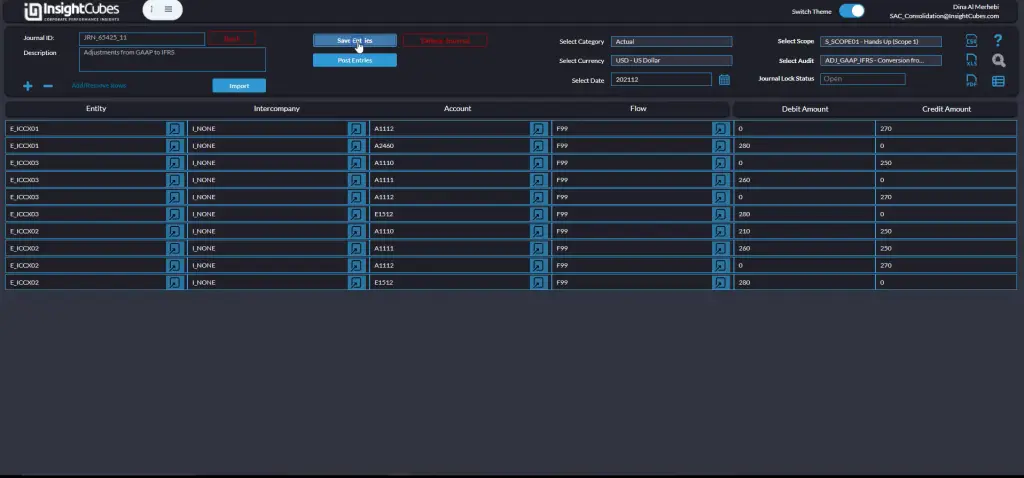

Saving data

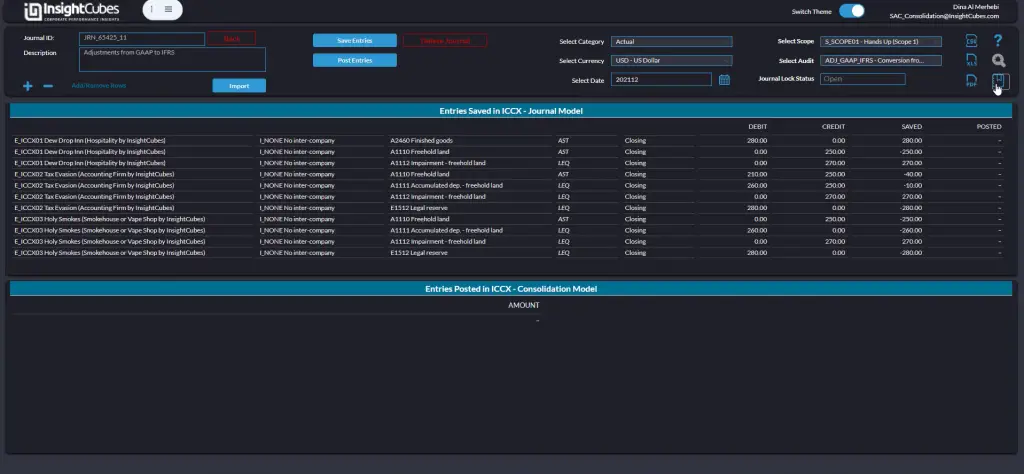

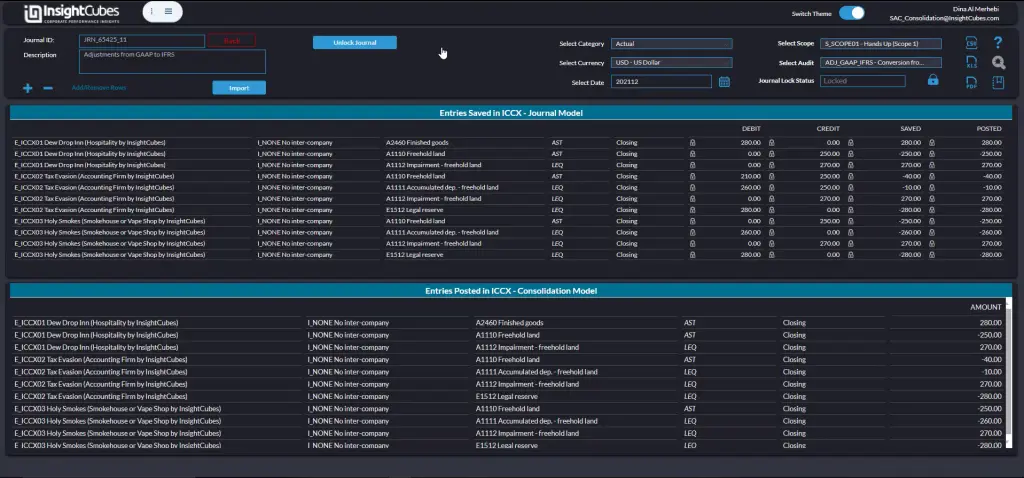

Once journal entries are added, click “Save” to store them temporarily. This allows users to review and adjust entries before finalizing.

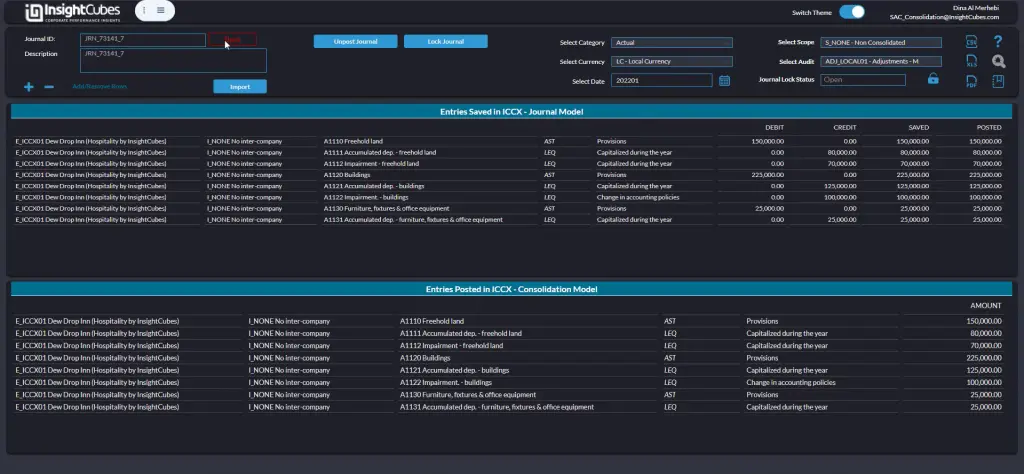

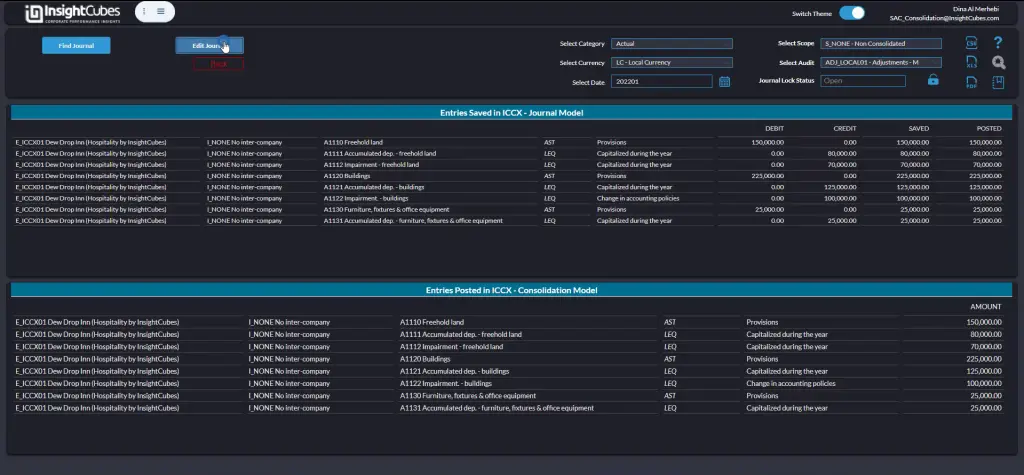

To verify saved values, click “Report View” to display debit, credit, and saved amounts in the journal table.

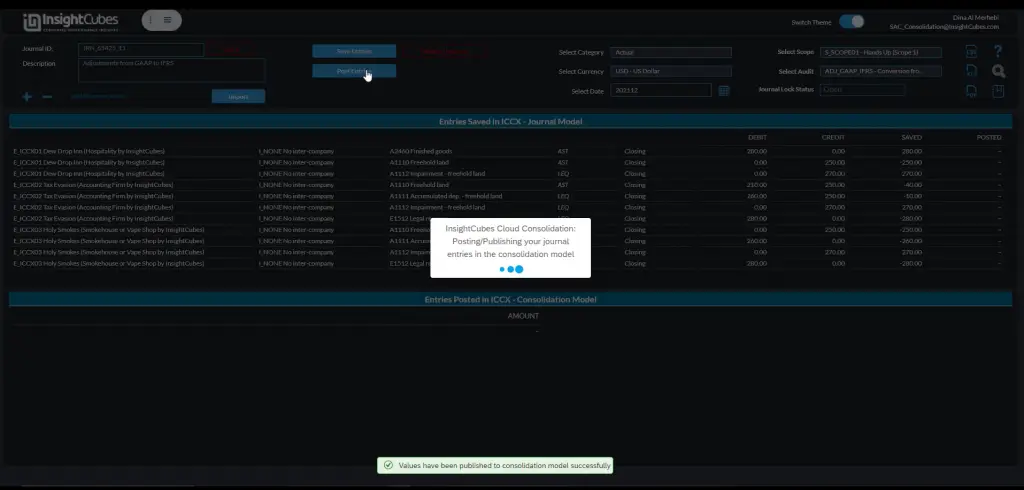

Posting entries

Click “Post Entries” to publish journal values to the consolidation model. This updates financial records by adjusting amounts according to the debit and credit values, ensuring accurate financial reporting.

Locking and Unlocking Journals

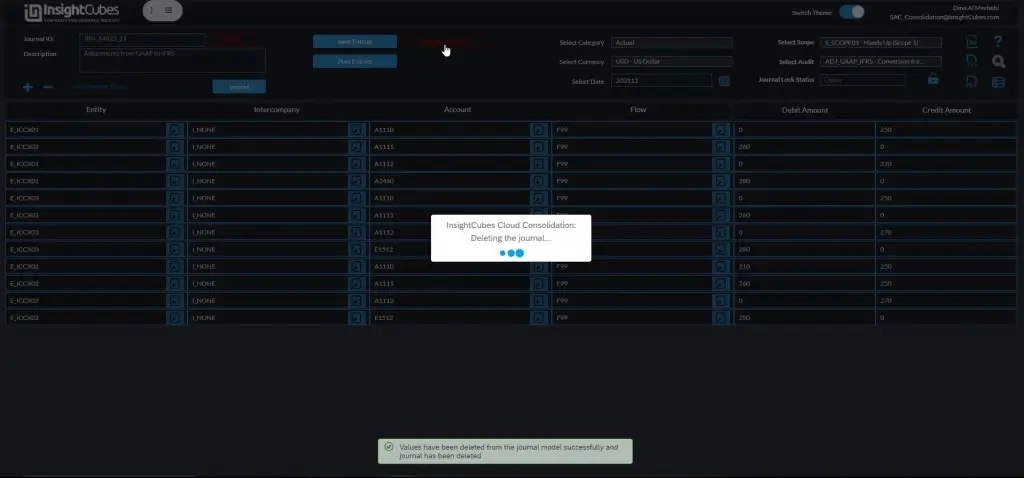

To prevent further modifications, click “Lock” after saving and posting a journal entry. Only users with Journal Manager roles can lock journals. To modify or delete a journal, unlock it first. Unlocking allows journals to be edited, unposted, or deleted.

Finding and Editing a Journal Entry

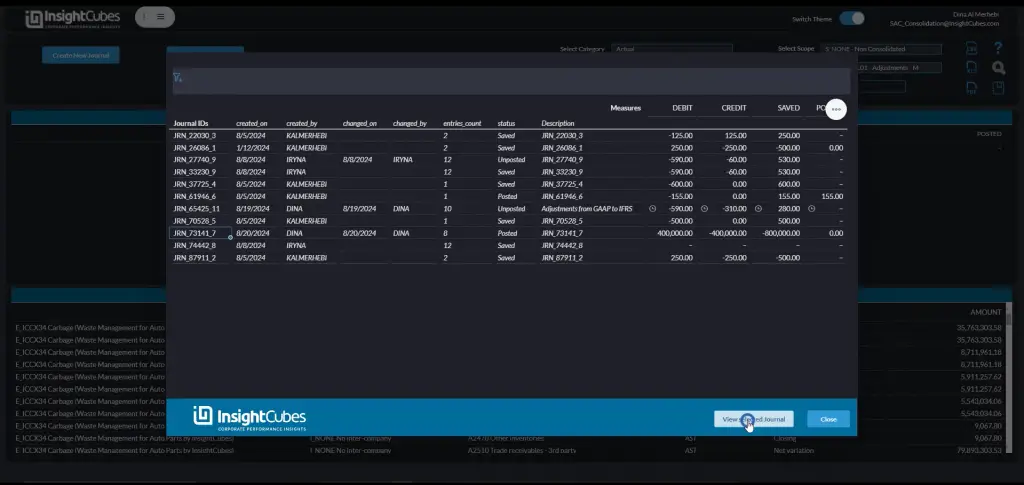

To retrieve an existing journal:

- Click “Find Journal”.

- Select the desired journal from the popup list.

- Click “View Selected Journal” to open it.

- To edit a journal, click “Edit Journal”, modify the necessary data, and then save changes.

The journal with all the saved and published records on both the InsightCubes Journals Model and InsightCubes Cloud Consolidation Model reports are open.

Data can be changed in edit mode’s table view simply through selecting the data point, updating the information, and clicking the save entries button.

Related Insights and Further Reading

For more details on financial consolidation and automation, explore:

- SAP Analytics Cloud Consolidation Extension

- How to Automate Adjustments in SAP BPC

- ESG and GHG Calculation Models in SAP Analytics Cloud

By leveraging SAP Analytics Cloud Journals, organizations can maintain accurate financial records, enforce governance, and streamline consolidation workflows.