InsightCubes Real Estate Analysis Solution

The real estate industry is a significant part of a country’s economy, involving the development, ownership, and management of property; hence, data-driven decision-making is not just an advantage—it’s a necessity. InsightCubes Real Estate Analysis solution for SAP Analytics Cloud (SAC) provides organizations with a comprehensive framework to manage, analyze, and optimize their real estate portfolios. This purpose-built model integrates robust features and functionalities, empowering real estate professionals with actionable insights and streamlined planning capabilities.

Whether you’re a property manager, financial analyst, or C-suite executive, this solution transforms how you approach real estate management. Let’s explore its benefits, features, and functionalities, and how it can revolutionize your operations.

Benefits of InsightCubes' Real Estate Analysis solution

- Data-Driven Decision Making

The ICPX Real Estate model centralizes data from various dimensions such as properties, tenants, lease types, and cost centers, enabling decision-makers to:

- Analyze trends in revenue and expenses.

- Identify underperforming assets and high-growth opportunities.

- Optimize tenant mix and occupancy strategies.

With a unified view, you can eliminate data silos and make strategic, evidence-based decisions.

- Enhanced Financial Performance

By integrating financial KPIs such as Net Operating Income (NOI), Debt Service Coverage Ratio (DSCR), and Operating Expense Ratio, the model helps businesses:

- Pinpoint cost-saving opportunities.

- Boost profitability across their property portfolio.

- Plan for long-term growth with accurate financial forecasting.

- Streamlined Operational Planning

Real estate operations often involve a complex mix of maintenance schedules, service provider management, and resource allocation. The ICPX model streamlines these processes by:

- Providing detailed maintenance cost analysis.

- Allowing for effective service provider performance evaluation.

- Enabling precise resource allocation to meet property-specific needs.

- Improved Portfolio Management

For businesses managing properties across multiple regions or asset classes, the ICPX model facilitates:

- Portfolio diversification planning.

- Regional performance benchmarking.

- Strategic market entry or exit decisions.

By leveraging SAC’s live data connections, you can track portfolio health in real time.

- Predictive Analytics for Proactive Decision-Making

The Real Estate Analysis solution leverages SAP Analytics Cloud’s predictive capabilities, enabling organizations to:

- Forecast revenue, expenses, and occupancy trends with high accuracy.

- Identify potential risks, such as tenant churn or market downturns, before they impact performance.

- Develop data-backed strategies for lease renewals, property upgrades, and portfolio diversification.

By integrating predictive insights, the solution empowers real estate professionals to stay ahead of market dynamics and make proactive, informed decisions.

Key Features of InsightCubes Real Estate Analysis solution for SAC

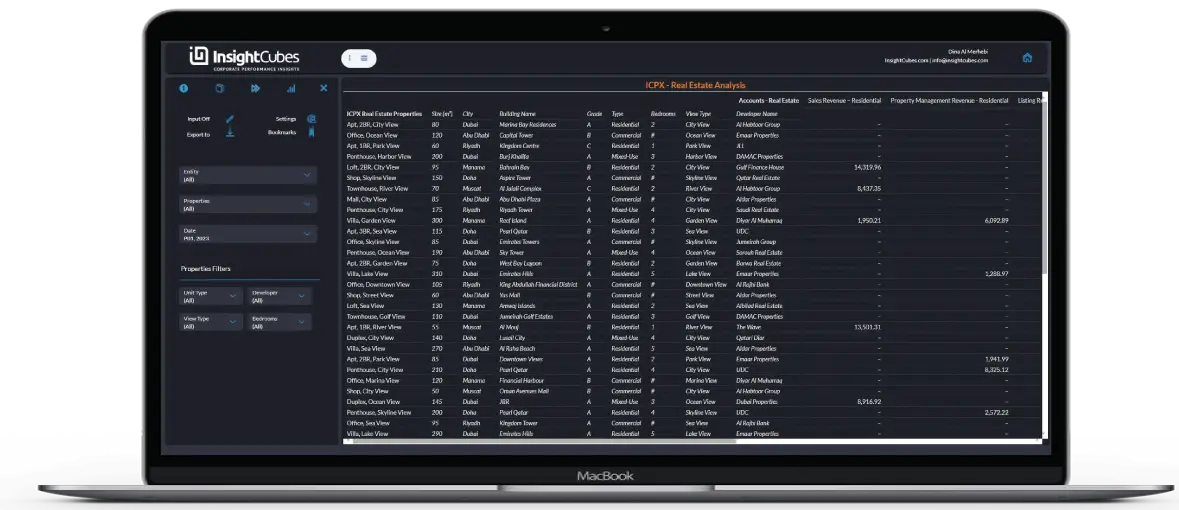

The ICPX – Real Estate Analysis Model is designed with a robust set of dimensions, enabling detailed analysis and reporting tailored to the real estate industry. These dimensions provide actionable insights across properties, tenants, leases, and financial metrics.

- ICPX_RE_PROPERTIES: For property-specific analysis.

- ICPX_RE_TENANTTYPE: To differentiate tenant categories and evaluate their profitability.

- ICPX_RE_LEASETYPE: To analyze lease structures and their revenue contribution.

- ICPX_RE_CURRENCY: For multi-currency reporting and financial planning.

- ICPX_RE_COST_CENTER: For tracking expenses by operational units or properties.

- ICPX_RE_SERVICE_PROVIDER: To evaluate service provider efficiency and associated costs.

- ICPX_RE_ACCOUNT: For financial performance tracking, including revenues and operational expenses.

- ICPX_RE_DATE: To enable time-based analysis, such as trends, forecasts, and historical benchmarking.

- ICPX_RE_ENTITY: For multi-entity reporting, allowing businesses to analyze performance by region, country, or organizational unit.

- ICPX_RE_PROFIT_CENTER: To evaluate profitability by specific business segments or operational divisions.

- ICPX_RE_TENANT: For tracking individual tenant performance, lease compliance, and retention rates.

These dimensions ensure that the ICPX – Real Estate model provides the depth and flexibility required for comprehensive real estate analysis and planning. With these capabilities, businesses can make informed, data-driven decisions that align with their strategic objectives.

The ICPX – Real Estate Analysis Model comes with a suite of pre-configured financial KPIs that offer instant insights into real estate performance. These KPIs are tailored to address the critical metrics needed for effective property and portfolio management.

- Gross Rental Income (GRI): Understand rental revenue sources.

- Cash Flow Margin: Assess liquidity at the property or portfolio level.

- Cost Per Square meter: Benchmark operational efficiency across properties.

- Net Operating Income (NOI): Measure property profitability before financing and taxes.

- Operating Expense Ratio: Evaluate cost efficiency by comparing expenses to revenue.

- Debt Service Coverage Ratio (DSCR): Assess the ability to cover debt obligations with operating income.

- Vacancy Rate: Monitor underutilized properties and identify revenue gaps.

- Revenue Growth Rate: Track changes in revenue over specific periods.

- Maintenance Cost Per Property: Evaluate the efficiency of maintenance spending.

- Profitability by Tenant Type: Identify the most profitable tenant categories.

- Service Provider Efficiency: Measure cost-effectiveness of outsourced services.

- Revenue Contribution by Lease Type: Understand how different lease structures drive income.

- Break-Even Occupancy: Determine the minimum occupancy required to cover expenses.

These KPIs provide the foundation for comprehensive performance analysis, enabling real estate businesses to optimize profitability, control costs, and enhance operational efficiency. By leveraging these ready-to-use metrics in SAP Analytics Cloud, companies can focus on strategic decision-making with minimal setup.

With SAP Analytics Cloud’s advanced planning capabilities, the ICPX – Real Estate Analysis Model empowers businesses to simulate various scenarios and make informed decisions. This flexibility is crucial for navigating the complexities of real estate management. The model supports:

- What-If Analysis: Evaluate the impact of market changes, rent adjustments, or property upgrades.

- Multi-Scenario Comparisons: Compare optimistic, pessimistic, and baseline scenarios to prepare for uncertainties.

- Lease vs. Sell Analysis: Simulate the financial and operational implications of leasing versus selling properties, factoring in long-term cash flows, market demand, and ROI.

- Market Expansion or Exit Strategies: Assess the profitability of entering new markets or divesting from underperforming regions.

- Lease Renewal Scenarios: Analyze the impact of different lease renewal rates or terms on revenue and occupancy.

- Capital Expenditure (CapEx) Planning: Explore the outcomes of investing in property upgrades or delaying renovations, including ROI and tenant satisfaction.

- Tenant Mix Optimization: Simulate how changes in tenant categories or lease structures affect profitability and risk diversification.

- Vacancy Impact Assessment: Plan for revenue losses and cost adjustments under varying vacancy scenarios.

- Regulatory Change Adaptation: Model the financial effects of new tax laws, zoning regulations, or accounting standards.

- Energy Efficiency Investments: Compare scenarios for implementing energy-efficient upgrades, factoring in cost savings, sustainability goals, and property value enhancement.

- Debt Restructuring Scenarios: Evaluate how refinancing loans or altering debt obligations could impact cash flow and DSCR.

These scenario planning capabilities ensure real estate professionals can anticipate and adapt to market dynamics, tenant behavior, and operational challenges, making the ICPX model in SAP Analytics Cloud an invaluable tool for strategic planning.

The ICPX model integrates seamlessly with live data sources such as SAP S/4HANA and SAP BW/4HANA, offering:

- Real-time insights for timely decision-making.

- Reduced manual effort by eliminating the need for frequent data imports.

The ICPX – Real Estate Analysis Model in SAP Analytics Cloud (SAC) offers cutting-edge visualizations and dashboards that cater specifically to the needs of real estate professionals. These dashboards are designed to provide actionable insights into property performance, tenant dynamics, and financial health, enabling data-driven decision-making.

Key Features of Real Estate Dashboards

Occupancy and Vacancy Tracking

- Occupancy Dashboards: Visualize current occupancy rates, vacant units, and historical trends across properties.

- Vacancy Heatmaps: Highlight properties or regions with higher vacancy levels to prioritize marketing and leasing efforts.

- Lease Expiration Calendar: Display upcoming lease expirations to aid in proactive tenant retention and renewal planning.

Tenant Performance and Retention

- Track tenant retention rates by property, region, or tenant type.

- Analyze tenant profitability and segment tenants by revenue contribution.

- Monitor at-risk tenants with indicators like late payments or lease non-renewal probabilities.

Revenue and Financial Insights

- Revenue Dashboards: Present total rental income, service revenue, and revenue growth across properties or tenant categories.

- KPI Overviews: Include key financial metrics like Net Operating Income (NOI), Debt Service Coverage Ratio (DSCR), and Cash Flow Margin.

- Profitability Analysis: Compare the financial performance of properties, tenant types, or lease structures.

Maintenance and Operational Monitoring

- Visualize maintenance schedules and track costs by property, service provider, or type of service.

- Display overdue maintenance tasks or repair budgets exceeding limits.

- Monitor energy usage and sustainability metrics for properties pursuing green initiatives.

Portfolio-Level Summaries

- Provide a high-level view of portfolio performance across regions, property types, or entities.

- Compare regional trends, such as average occupancy, revenue per square foot, or operating costs.

- Identify underperforming properties for targeted improvement plans or divestment decisions.

Scenario Planning Visualizations

- Compare optimistic, pessimistic, and baseline scenarios visually to evaluate the impact of market fluctuations, lease changes, or property investments.

- Simulate the financial outcomes of leasing versus selling properties or entering/exiting markets.

Geospatial Analysis

- Display properties on an interactive map with performance overlays (e.g., revenue, occupancy, or maintenance costs).

- Identify regional hotspots or underperforming areas geographically for targeted action.

Usability and Accessibility

- Customizable Dashboards: Tailor dashboards to specific user roles, such as property managers, finance teams, or executives.

- Drill-Down Capabilities: Allow users to click into summarized metrics for more detailed property-level or tenant-level data.

- Real-Time Updates: With live data connections to systems like SAP S/4HANA, dashboards reflect up-to-date metrics and trends.

- Mobile Access: View dashboards on-the-go with SAC’s mobile-friendly interface, ensuring accessibility anywhere.

These visualizations not only simplify complex data but also empower real estate professionals to act swiftly and strategically. With advanced dashboards in SAC, businesses can stay competitive, maximize portfolio performance, and deliver value to stakeholders.

Functionalities Tailored for Real Estate Professionals

Unlike generic planning models, the ICPX model is tailored specifically for the real estate industry. It is suitable for small businesses managing a few properties or global enterprises with expansive portfolios, and built to work effortlessly with SAP Analytics Cloud, ensuring smooth adoption and minimal disruption.

- Financial Planning for:

- Revenue growth based on tenant and lease data.

- Operational and capital expenditure budgets.

- Debt servicing obligations with DSCR analysis.

- Lease and Tenant Management

- Track lease expirations and plan renewals.

- Evaluate tenant profitability by segment.

- Monitor occupancy and vacancy rates to optimize property utilization.

- Operational Efficiency

- Conduct detailed expense planning

- Allocate maintenance budgets effectively.

- Evaluate service provider performance against cost benchmarks.

- Strategic Portfolio Management

- Develop diversification strategies by region or property type.

- Identify high-performing markets for expansion.

- Strategize exits from underperforming regions.

Insightcubes’ Real Estate Analysis solution for SAP Analytics Cloud is a game-changer for the real estate industry. By centralizing data, providing actionable insights, and simplifying complex planning processes, it empowers businesses to thrive in a competitive market. Whether your goal is to improve profitability, enhance operational efficiency, or expand your portfolio strategically; InsightCubes Real estate solution offers the tools you need to succeed.

For more real estate solutions visit our Lease Management solution and have measurable results.