In the prior blog, I described how the detailed currency conversion works on the Cloud Consolidation Extension for SAP Analytics Cloud. In this blog, I will describe the automated eliminations and adjustments that will happen once the user triggered the consolidation logic. Due to the size of the content, i will break the Automated Elimination and Adjustments blog into a few smaller, more bite size blogs.

InsightCubes Consolidation extension for SAP Analytics Cloud comes preconfigured with a set of consolidation methods and elimination rules that should cover over 80% of the IFRS consolidation requirements; this is based on 14 years of experience in developing consolidation solutions for holding companies with subsidiaries and affiliates in multiple industries.

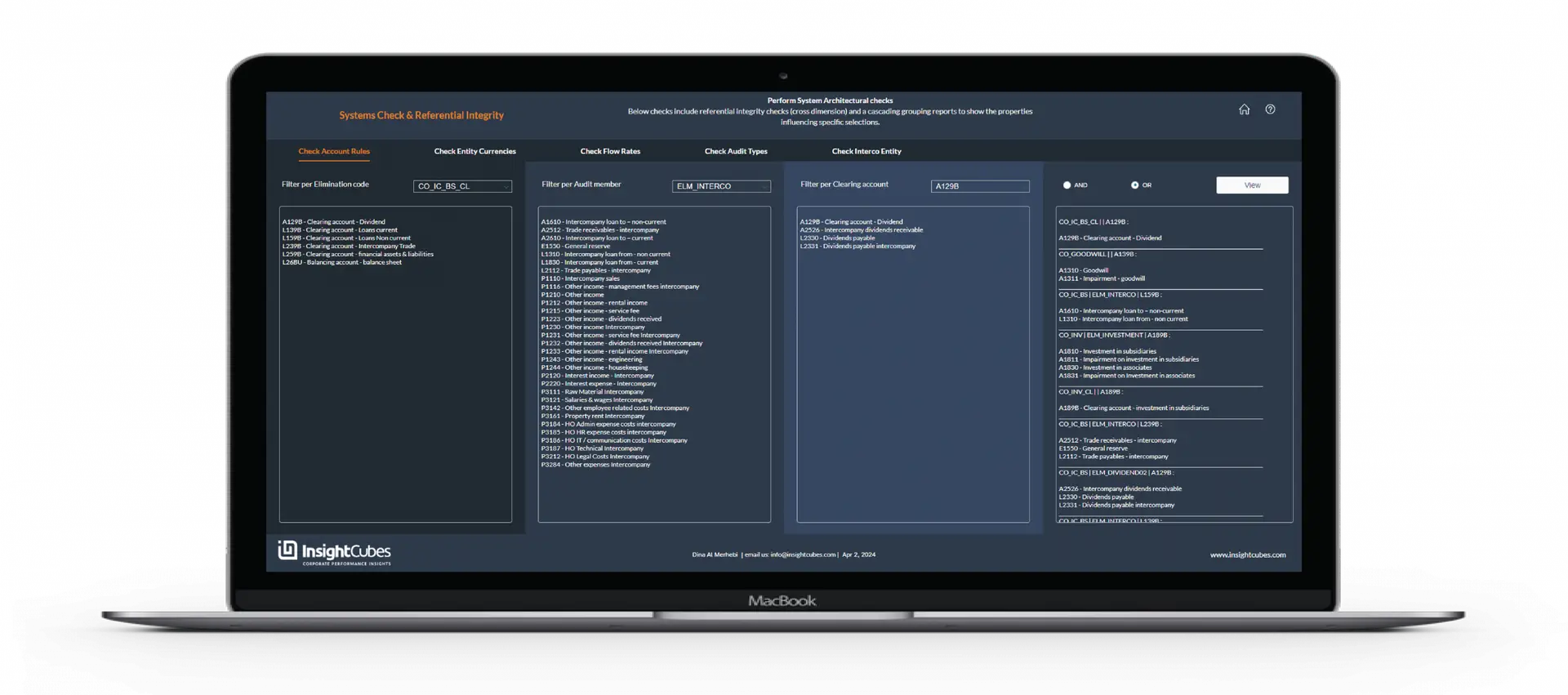

It is worth noting from the beginning, that all the below Eliminations and automated adjustments are based on data action triggers linked to advanced formulas and logic, that run purely on member attributes (except one logic related to net income for the period). So, no coding is required to adjust and adopt the solution, as long as the requirements are within the set of defined rules. Assigning specific attributes to accounts, entities, scopes, and intercompany members in their respective dimensions is suffice to have the rules applied. This can be done in a guided manner using the Configuration Toolkit.

Additional automated elimination rules that aren’t being listed can be easily incorporated into another version of the data action trigger.

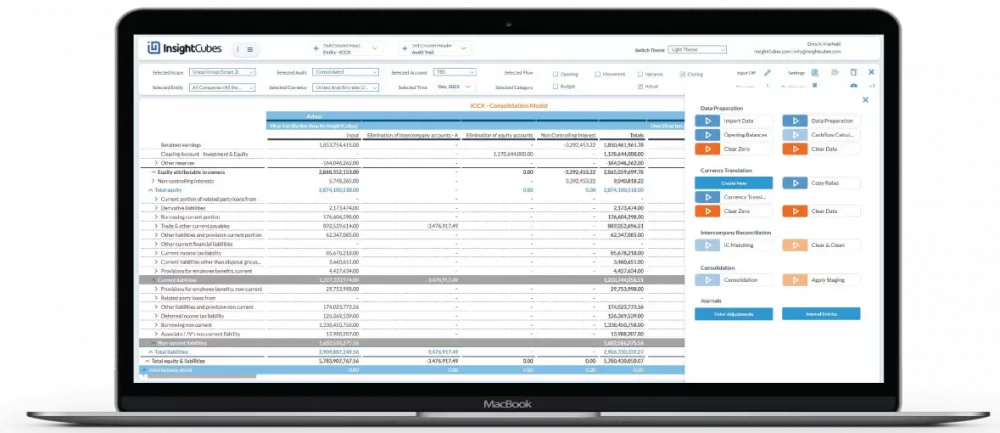

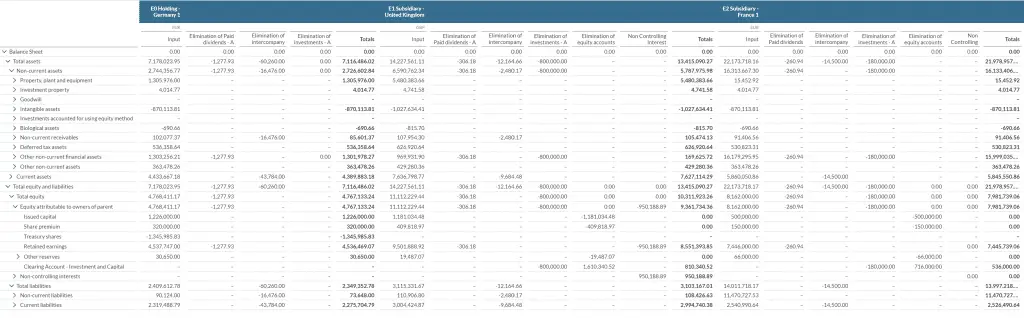

In this blog, we will be covering automated elimination based on different consolidation methods, whereas each elimination has a specific sequence of logic. From a technical perspective, we selected a set of these eliminations to showcase the methods of sequential manipulation of data to generate eliminated values. In some cases, the values are picked from the Intercompany breakdown of the entity, and posted on the entity itself. In other cases, the logic will invest entity with its intercompany and intercompany with its entity, and it additional cases, the intercompany breakdown is not even used in the calculations. Furthermore, some logic will knock off a set of accounts and reflect their residual value, while other logic would have a three leg entry. From a technical perspective, the combination of all these methods of data manipulation to eliminate and adjust can be reused to create any array of elimination and adjustments. Since the eliminations and adjustments work on Attribute Values, and not fixed members, by adding new attributes and reusing the formulas to target the new attributes, the logic can be composed as desired.

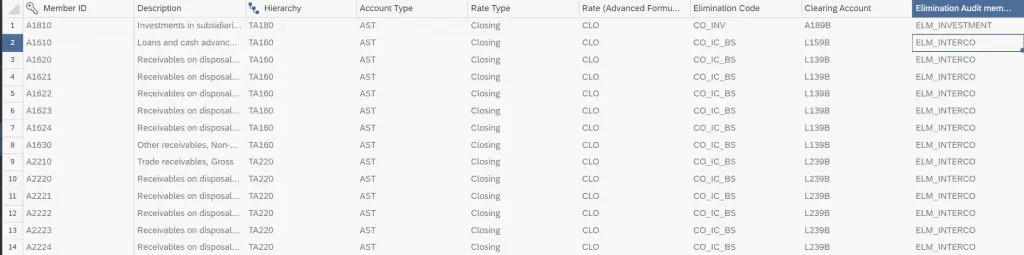

In the above screenshot, we highlight three properties in the account dimension (as an example).

The Account A1810 has a property value of CO_INV under Elimination Code and a clearing account A189B, with Elimination Audit member ELM_INVESTMENT. By assigning these property values to another account, the rules will be applied to it. The Eliminations and Adjustments rules do not need to be changed if we have to apply the logic to your COA. Also, We can add new audit members in the audit ID dimension, and specify in the Elimination Audit Member column which audit member will host the elimination without changing the rules. It will write back to the destination audit member automatically, based on the assignment in the account dimension. There are other properties in the intercompany, entity, scope, flow, currency and other dimensions that behave in the same manner, ensuring new zero additional coding when adopting the solution and applying your own master data.

By just maintaining the properties values for the master data, you would have configured over 90% of the solution. Few calculations are based on fixed accounts (Such as retained earning – E1610 or Net income (loss) attributable to noncontrolling interest – P8000) and can be easily changed in the Advanced Formulas.

They are even highlighted with a text “Change Account ID here”

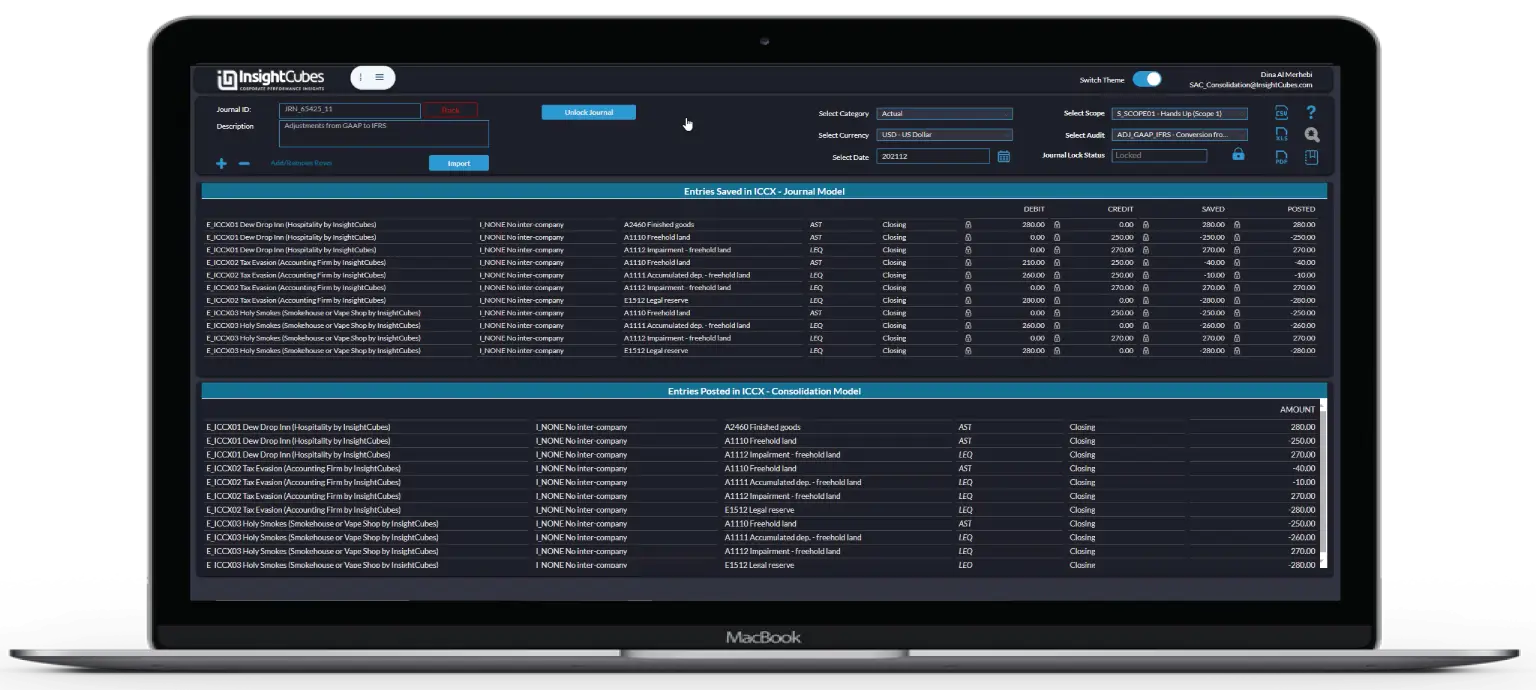

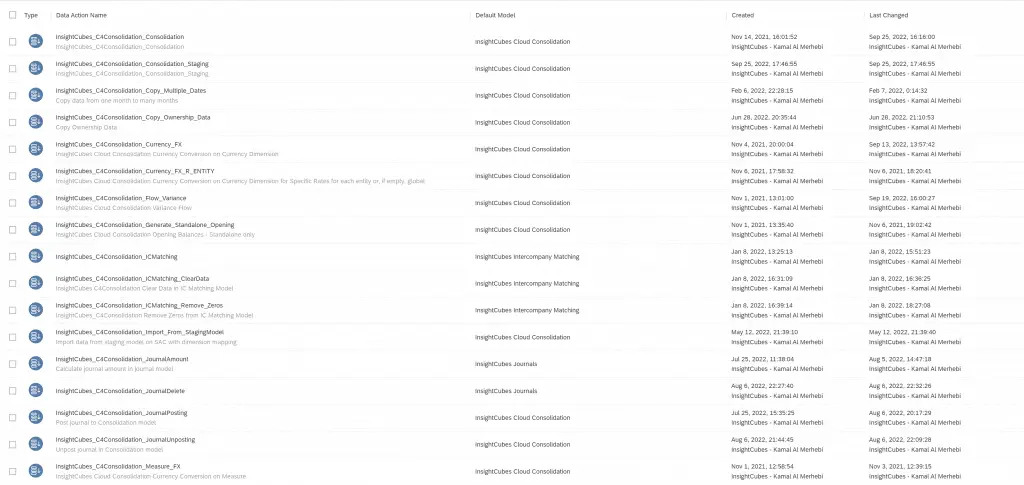

InsightCubes Consolidation Extension for SAP Analytics Cloud comes with an extensive list of Advanced Formulas and Java Script embedded in Analytics Applications that rely on each other. Each Advanced Formula is composed of multiple sequential steps. For the same logic, you can have alternative methods of calculations by selecting from the list. Example: You can run currency conversion based on global rates only, or, run based on global and entity specific rates. You can run consolidation based on direct and indirect ownership without staging, or run staging method consolidation. All these advanced formulas and java script preparatory logic rely on the same architecture and member attributes, and will work consistently based on the assignment of property values.

Consolidation Methods

The Consolidation extension for SAP Analytics Cloud includes four methods of consolidation, since they are the most commonly used and adopted.

- Holding

- Full

- Equity

- Proportionate

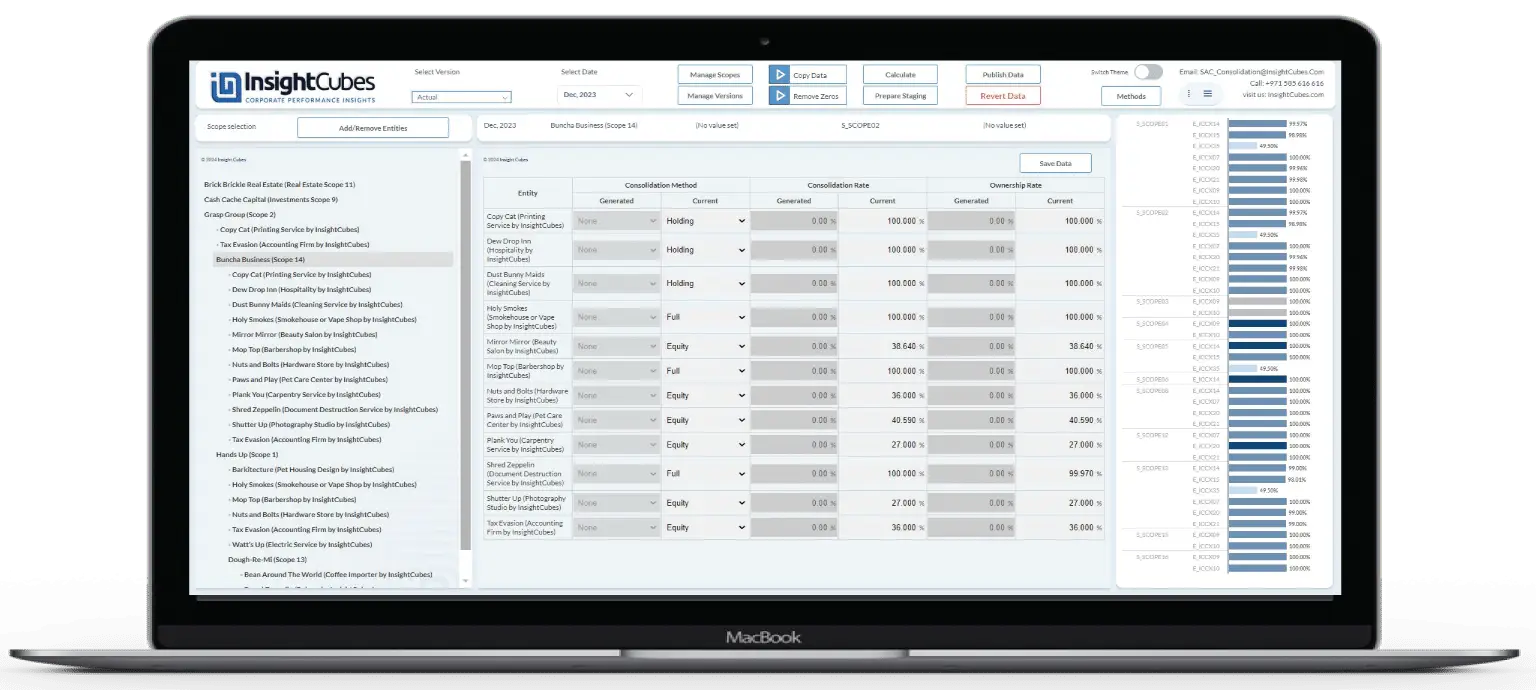

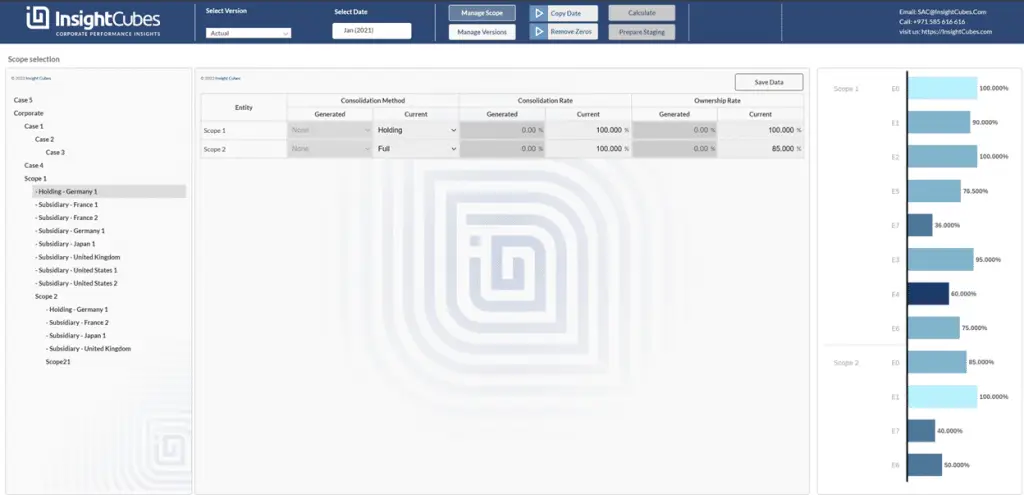

The methods are entered through the ownership manager interface and will dictate the set of rules that will be used at the execution of the consolidation process. In the Managing Ownership Structure blog, we discuss this in further details, but for now, the below screenshot shows Scope 1 being a parent scope to Scope 2 (this is not a hierarchy/Parent Child relationship), and within Scope 1, Holding Germany 1 is the holding company and the rest are subsidiaries (Full Consolidation method) except for France 2 being an affiliate (Equity Consolidation Method). The ownership and consolidation rates have been entered for each entity within Scope 1.

- The Holding method is assigned to the holding company within a Scope. This is the investor company.

- The full method is assigned to the subsidiaries within the scope (investees with majority control by the holding). These are the companies that the holding company has majority control over.

- The Equity method is assigned to the affiliate companies within the scope (investees with no majority control). These are the companies that the holding company doesn’t have majority control over. Only the equity pickup rule and investment revaluation is applied to companies assigned the equity method.

By assigning the methods through the ownership manager and clicking on Run Consolidation, the system should run all the sequence of logic to generate a set of fully consolidated financial statements based on the relationship between the entities within a scope.

The set of eliminations that have been used for this demonstrative blog do not include elimination of hedging reserve, dividends paid or Share in Earning. The values entered onto the balance sheet and P&L with their intercompany and investment breakdown have not been done to uphold financial validity; the purpose is to show how the eliminations are done and what will happen to differences between investment and equity accounts, and between intercompany transactions.

In the next blog, I will go in details on the first set of automated eliminations, the intercompany eliminations