In the prior part of this blog, I discussed the different consolidation methods and how the Automated eliminations and adjustments run on the attribute values of members across dimensions. In this part, I will describe the intercompany eliminations carried out automatically by the Cloud Consolidation Extension for SAP Analytics Cloud.

Please do note, that SAP Analytics Cloud has intercompany elimination using ELIMMEMBER. This is not related to the eliminations i am describing, since ELIMMEMBER will eliminate irrespective of consolidation method or scope, furthermore, ELIMMEMBER does not conduct the eliminations per intercompany/partner and reflect the residual or provide option for matching and booking differences between intercompany transactions. Whereas, the Intercompany eliminations that I will be describing will do all the mentioned. If you want to know more about ELIMMMEBER, please check out this blog.

With that being clarified, let us proceed with the first set of automated eliminations

Intercompany Eliminations

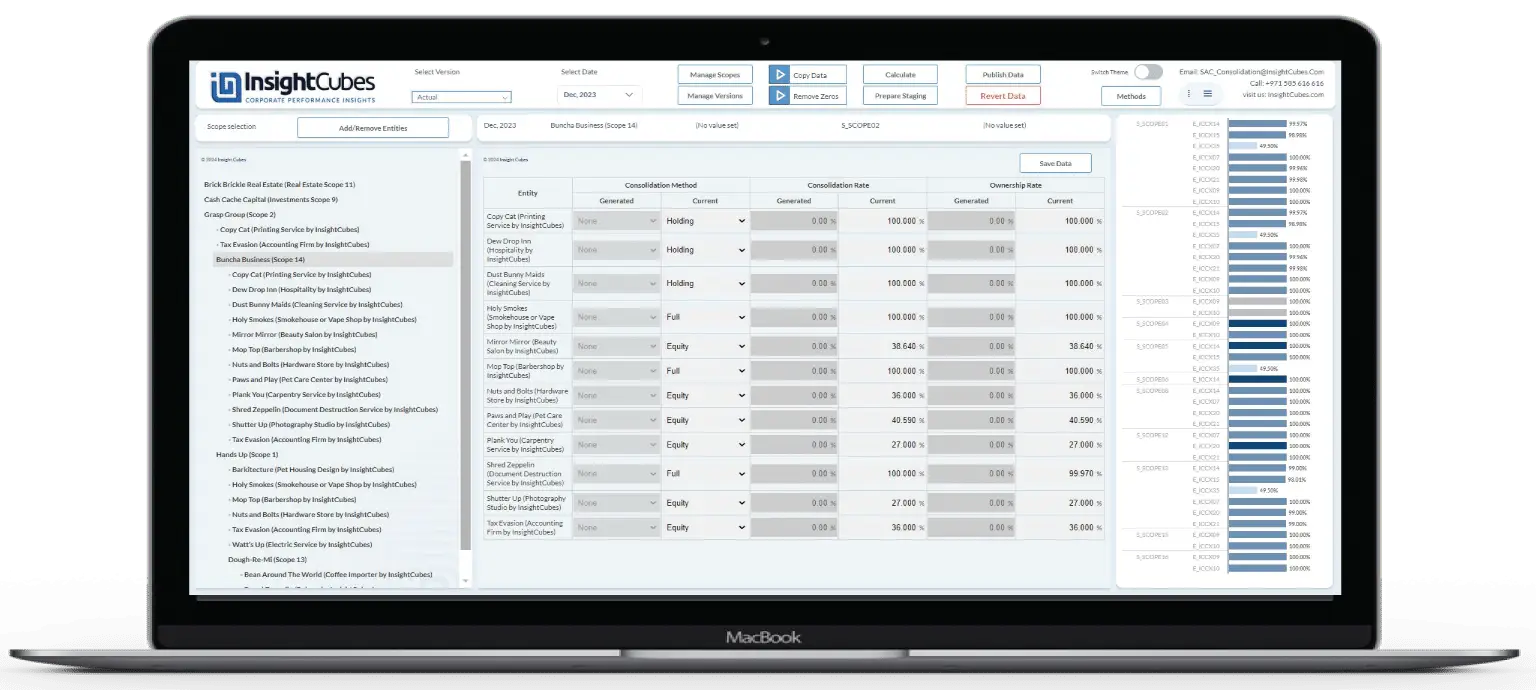

This automated process affects companies with a consolidation methods of Full and Holding, and will result in the elimination of all the intragroup assets and liabilities, income, expenses and cash flows relating to transactions between those entities within the same Consolidation Scope.

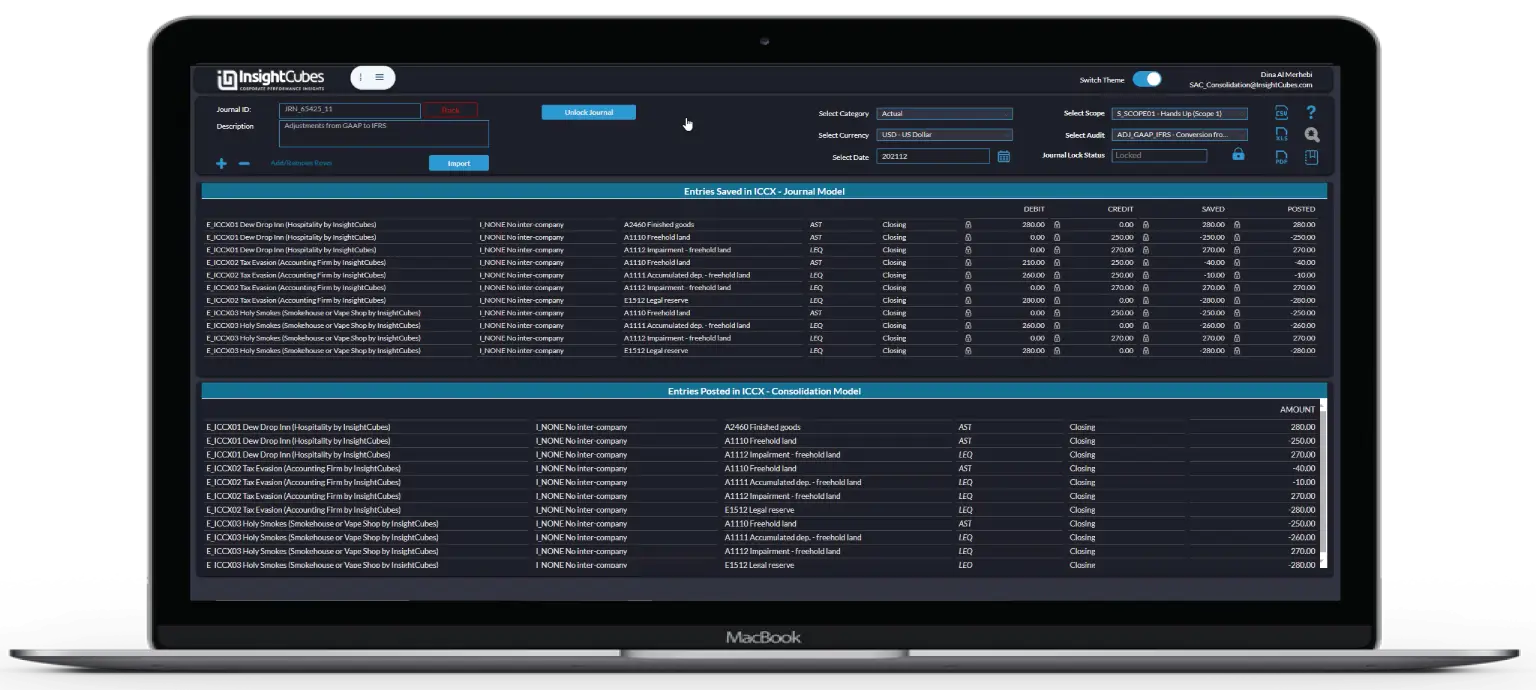

Ideally, Entity A records receivables from partner company/interco B for value of x, so in turn, Company B should have recorded payable to partner company/interco A for the same value. In many cases, this is not the case, so the Intercompany Matching model is used to book such differences and expedite the reconciliation. If you need to know now more about this topic, you can click on the IC MATCHING Blog.

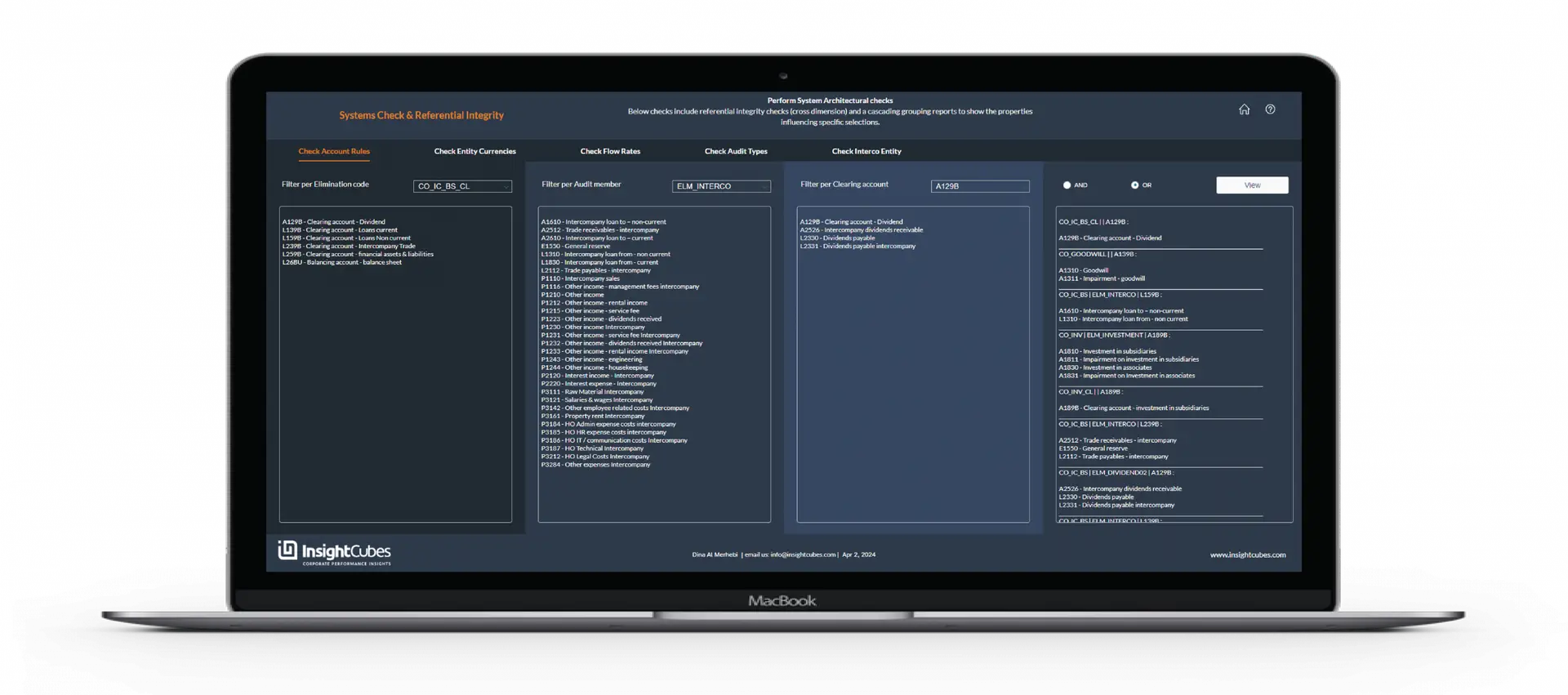

In the following examples, we will be viewing a small portion of data being eliminated within a scope. Unlike the native method of elimination in SAP Analytics Cloud that knocks off intercompany values irrespective of the method or scope they belong to (similar to US Eliminations Rule of BPC) , the Cloud Consolidation extension for SAP Analytics Cloud by InsightCubes conduct detailed method of elimination, whereas intercompany amounts between holding and subsidiaries, within the same scope, will be eliminated and a clearing account will reflect the differences. If differences exist, the IC MATCHING Model can be used to fast track the reconciliation.

E0 has intercompany transactions with its partner companies E1, E2, E4 and E6. These values are eliminated at intercompany level in full and, in turn, reducing the total value per account on I_NONE level (which is the total value of the account, including the intercompany and 3rd party). A clearing account will show the difference between the eliminated amounts.

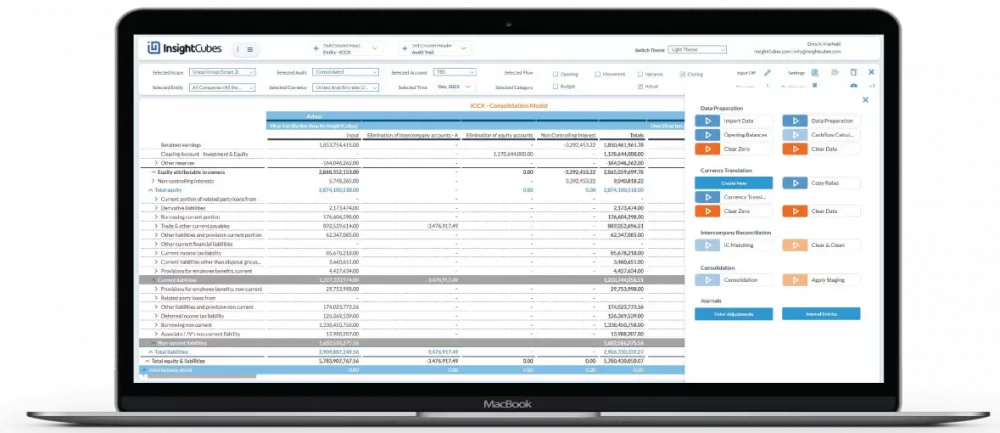

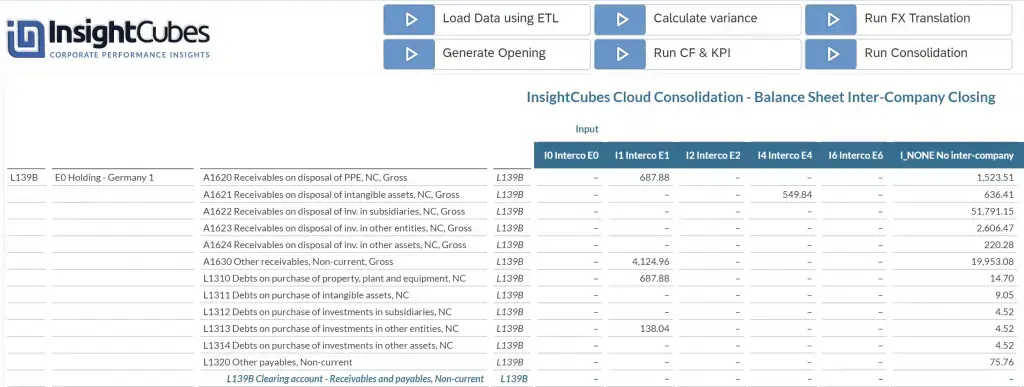

The below screenshot shows the intercompany transactions between E0 the remaining subsidiaries within the consolidation scope (SCOPE 1)

E0 has the following totals on all its intercompany accounts.

| A1620 Receivables on disposal of PPE, NC, Gross | 1,523.51 |

| A1621 Receivables on disposal of intangible assets, NC, Gross | 636.41 |

| A1622 Receivables on disposal of inv. in subsidiaries, NC, Gross | 51,791.15 |

| A1623 Receivables on disposal of inv. in other entities, NC, Gross | 2,606.47 |

| A1624 Receivables on disposal of inv. in other assets, NC, Gross | 220.28 |

| A1630 Other receivables, Non-current, Gross | 19,953.08 |

| L1310 Debts on purchase of property, plant and equipment, NC | 14.7 |

| L1311 Debts on purchase of intangible assets, NC | 9.05 |

| L1312 Debts on purchase of investments in subsidiaries, NC | 4.52 |

| L1313 Debts on purchase of investments in other entities, NC | 4.52 |

| L1314 Debts on purchase of investments in other assets, NC | 4.52 |

| L1320 Other payables, Non-current | 75.76 |

However, only a portion of these accounts have intercompany transactions with the subsidiaries within the scope that are subject to eliminations.

E0 has the following intercompany amounts with E1.

| A1620 Receivables on disposal of PPE, NC, Gross | 687.88 |

| A1630 Other receivables, Non-current, Gross | 4124.96 |

| L1310 Debts on purchase of property, plant and equipment, NC | 687.88 |

| L1313 Debts on purchase of investments in other entities, NC | 138.04 |

And the following transactions with E2

| A1621 Receivables on disposal of intangible assets, NC, Gross | 549.84 |

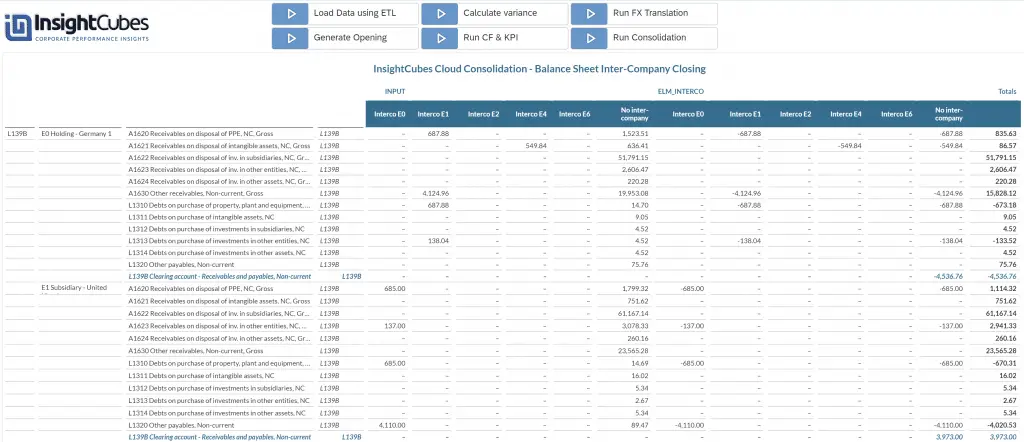

The intercompany transactions of all the partner companies with E0, within the same consolidation scope, were eliminated from the intercompany level of E1 in full, and the sum of all intercompany eliminations per accounts was reduced from the totals level (I_NONE) of the E0 company, generating the consolidated values per each account, net of intercompany amounts.

| Standalone Totals | Interco Eliminations | Consolidated Total | |

|---|---|---|---|

| A1620 Receivables on disposal of PPE, NC, Gross | 1,523.51 | (687.88) | 835.63 |

| A1621 Receivables on disposal of intangible assets, NC, Gross | 636.41 | (549.84) | 86.57 |

| A1622 Receivables on disposal of inv. in subsidiaries, NC, Gross | 51,791.15 | 51,791.15 | |

| A1623 Receivables on disposal of inv. in other entities, NC, Gross | 2,606.47 | 2,606.47 | |

| A1624 Receivables on disposal of inv. in other assets, NC, Gross | 220.28 | 220.28 | |

| A1630 Other receivables, Non-current, Gross | 19,953.08 | (4,124.96) | 15,828.12 |

| L1310 Debts on purchase of property, plant and equipment, NC | 14.70 | (687.88) | (673.18) |

| L1311 Debts on purchase of intangible assets, NC | 9.05 | 9.05 | |

| L1312 Debts on purchase of investments in subsidiaries, NC | 4.52 | 4.52 | |

| L1313 Debts on purchase of investments in other entities, NC | 4.52 | (138.04) | (133.52) |

| L1314 Debts on purchase of investments in other assets, NC | 4.52 | 4.52 | |

| L1320 Other payables, Non-current | 75.76 | 75.76 |

On the other hand, E1 (the subsidiary) has the intercompany transactions with its partner company E0 (the holidng company). These values were also eliminated on the intercompany level and reduced from the total level per each account.

Last, the differences between the intercompany values are reflected in a clearing account, per entity. These differences are between the group of intercompany accounts. Each clearing account is linked to a set of intercompany accounts that are subject to eliminations, and their differences are posted on the clearing accounts. Example: a clearing account between Loans payables and Loans receivables. The sun of intercompany eliminations for these two accounts, for all transactions with partner companies within the scope, will be reflected on the clearing account, if any.

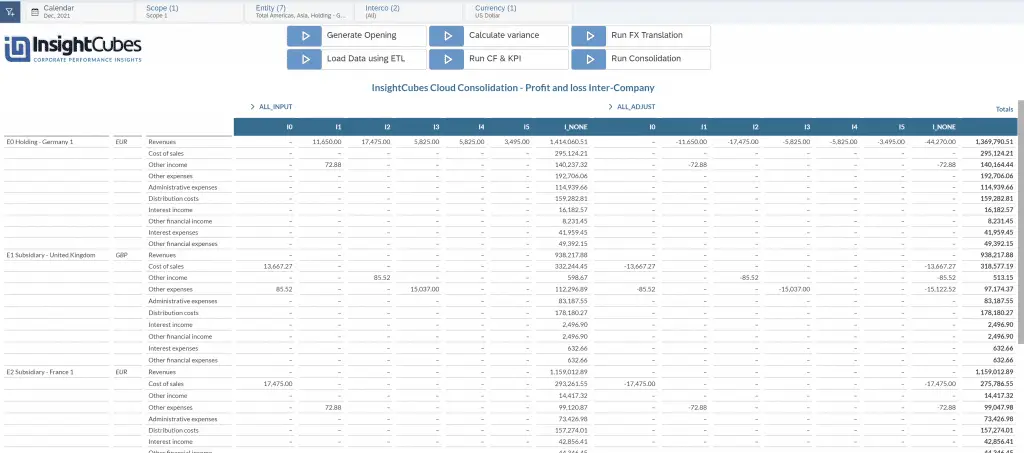

The same applies to the profit and loss intercompany transactions between the entities and partner companies within the same consolidation scope. The below report shows the P&L specific intercompany transactions between the different companies within a consolidation scope and their partner companies, their eliminations on intercompany level and impact on the totals level per account.

ALL_INPUT is a parent Audit Trail member that has the standalone values; it is composed of Manual Input, Uploaded Data, flat file uploads, Manual Adjustments and any set of audit trail members related to standalone values.

ALL_ADJUST is a parent Audit Trail member that includes specific audit members for each automated elimination (such as, an audit member for Elimination of Intercompany, Another audit member for elimination of investment, another for equity treatment and so on).

In the next part of this blog, I will describe the investment eliminations, dividend eliminations, equity treatment, Non controlling interest and other automated adjustments and eliminations.