In the prior part of the automated adjustments and eliminations blog series, I described the automated elimination of intercompany transactions among companies within the same scope. In this blog part, I will proceed with additional automated adjustments and eliminations carried out by the Cloud Consolidation Extension for SAP Analytics Cloud.

Investment Elimination

This automated process will eliminate the carrying amount of the parent’s investment in each subsidiary and the parent’s portion of equity in each subsidiary. This elimination is between the companies within the same scope that has a Holding Method Consolidation and Full Method Consolidation. The system retrieves the elimination amounts from the holding company’s investment breakdown.

Example of Investment Breakdown

In the above screenshot, E0 Holding – Germany 1 has a total amount of investments in subsidiaries, JV and associates of 1,242,000. The breakdown is:

- 800,000 EUR is the investment in E1 Subsidiary – United Kingdom

- 180,000 EUR is the investment in E2 Subsidiary – France 1

- 90,000 EUR is the investment in E3 Subsidiary – United States 1

- 82,000 EUR is the investment in E5 Subsidiary – Germany 1

- 40,000 EUR is the investment in E6 Subsidiary – Japan 1

- 50,000 EUR is the investment in PS2 Subsidiary Case 2

Similarly, E1 Subsidiary – United Kingdom also has a total amount of investments in subsidiaries, JV and associates of 760,000. The breakdown is:

- 110,000 GBP is the investment in E5 Subsidiary – Germany 1

- 450,000 GBP is the investment in E6 Subsidiary – japan 1

- 200,000 GBP is the investment in E7 Subsidiary – France 2

E2 Subsidiary – France 1 and E3 Subsidiary – United States 1 both have investments in subsidiaries, JV and associates, but there is no breakdown for them. (we added this to show they will not be subject to eliminations). It also worth noting that the Account Investment accounted for using equity method does not have any values and all values are in Investments in subsidiaries, JV and associates. The system applies elimination rules according to the ownership method.

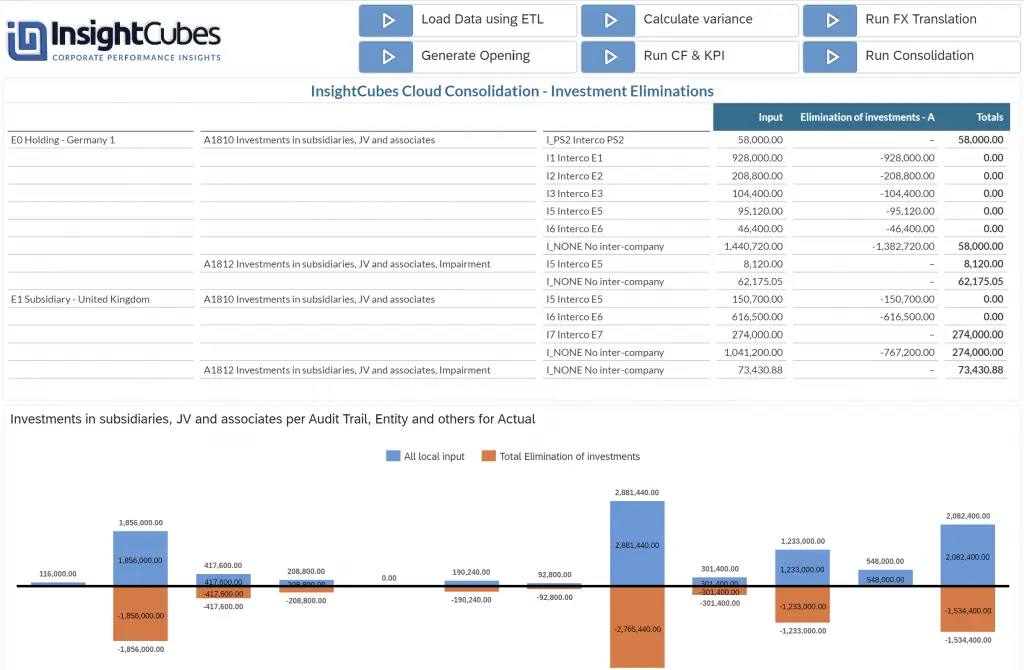

Currency Conversion and Intercompany Eliminations

The screenshot displays values in USD, while E0 uses Euro as its local currency. The system eliminates the converted values at the intercompany level, based on the investment breakdown per partner. Since PS2 is not part of Scope 1 consolidation, the system does not eliminate the investment in that company, and it does not integrate the PS2 trial balance into Scope 1. The system removes E1, E2, E3, E5, and E6 investments at the intercompany level and reduces the total investments in subsidiaries, JVs, and associates (I_NONE level) for E0 by the elimination amount. Since E0 holds E7 indirectly via E1 using the Equity Method, we will explain it in a later section of this blog.

Eliminations for Subsidiary Investments

Similarly, E1 investments in E5, E6 are eliminated and the total eliminated value on the investment breakdown is used to reduce the total investments in subsidiaries, JV and associates (I_NONE level). Since E7 is Equity Method of Consolidation, the investment is not eliminated at the intercompany breakdown level and is also not reduced from the total investments in subsidiaries, JV and associates (I_NONE level). The Automated Elimination and adjustments for affiliates of Equity method of consolidation will be covered in a preceding section.

The Cloud Consolidation solution first identifies which entities fall under the consolidation scope and records their consolidation methods. The system applies the rule to all holding and full-method entities. Next, it retrieves the investment breakdown from the holding company’s books for each subsidiary and eliminates it. The system then aggregates the total eliminated values per partner at the holding company level, reducing the total investments in subsidiaries, JVs, and associates. In the next step, the system matches each eliminated investment with the corresponding eliminated equity accounts from the partner company (investee) within the scope.

Equity Treatment and Disclosure of Non-Controlling Interest

The last main step in the consolidation of subsidiaries (companies assigned full method of consolidation) and their holding company is the elimination of specific equity accounts and disclosure of non-controlling interest.

Reporting Non-Controlling Interests

Within a scope, the holding company reports non-controlling interests in its consolidated statement of financial position within equity, separately from the equity of the owners of the parent.

The subsidiaries allocate their profit or loss and each component of other comprehensive income to the holding company based on ownership percentage. The system assigns the residual value to non-controlling interests. For both surplus and deficit balances, the system distributes amounts to the holding company and non-controlling interests according to the ownership percentage.

Assigning Properties for Equity Elimination

The system assigns the property CO_EQUITY1 to all equity accounts subject to elimination and eliminates them in full. For accounts that need adjustment according to ownership percentage, the system applies the CO_EQUITY2 property. InsightCubes Cloud Consolidation Extension for SAP Analytics Cloud will determine which company is the holding entity within the Scope/group and which ones are the Subsidiaries (full method) to start applying the logic.

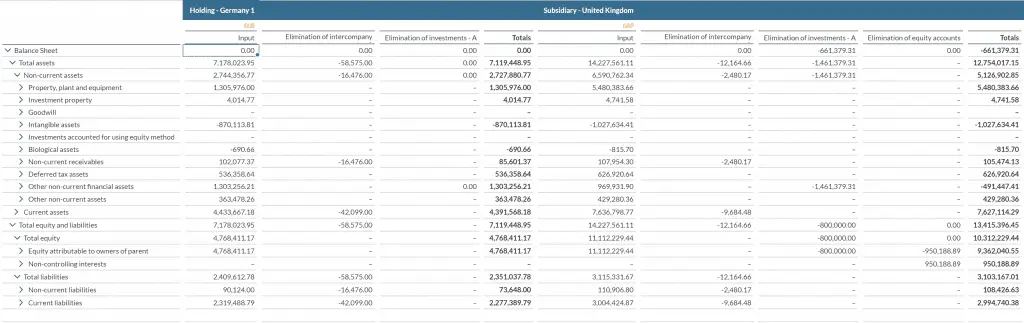

Elimination of Subsidiaries’ Equity

The Holding company will not have any eliminations or adjustments to its equity accounts, however the subsidiaries will get their capital, share premium and all accounts with a property of CO_EQUITY1 eliminated in full. The system retains the portion of retained earnings corresponding to ownership. It moves the remaining portion from retained earnings to the NCI account.

If the investment recorded by the holding company does not match the eliminated equity accounts, the system records the difference in a clearing account.

In the screenshot above, E0 is the holding company under Scope 1, so the system does not eliminate any of its equity accounts. The system eliminates the subsidiaries’ Issued Capital, Share Premium, Revaluation Surplus, Before Tax, and Income Tax on Revaluation Surplus in full. These accounts carry the CO_EQUITY1 property, which triggers the elimination. The total eliminated value of all equity accounts for a subsidiary appears in the Clearing Account – Investment and Capital, under the audit trail “Elimination of Equity Accounts.” The system retrieves the eliminated investment in the subsidiary from the holding company’s investment breakdown and posts it to the subsidiary’s clearing account under “Elimination of Investment.” Finally, it records the difference between this eliminated investment and all eliminated equity accounts in the total.

Allocation to Non-Controlling Interests

Finally, because E0 owns 90% of E1 Subsidiary – United Kingdom, the system eliminates 10% of the retained earnings and allocates it to the NCI account. The system does not apply this logic to E2 – France, since E0 owns 100% of it.

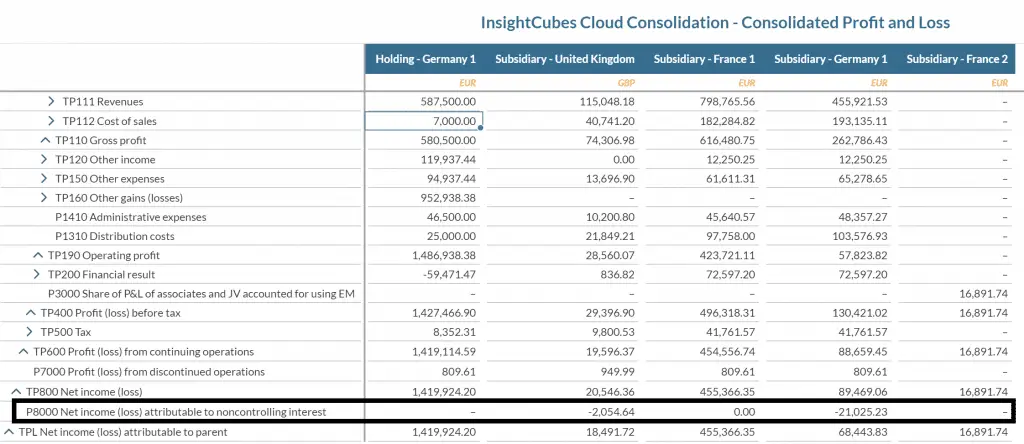

Similarly, The consolidated profit and loss will show Net Income (loss) attributable to noncontrolling interest, as a negative value to reduce the total consolidated P&L statement. 10% is declared as NCI for Subsidiary United Kingdom and 24.5% is also declared as NCI for Germany 1 (since it is owned by 76.5%)

Additional Eliminations

Shares in Earning (SIE), Hedging reserve, and dividends are all subject to eliminations.

The Dividends paid worksheet allows the user to break down the dividends paid by beneficiary among the group’s shareholders. The system inputs dividends received into the beneficiary’s income statement account -Dividends. These values are first converted using a dedicated exchange rate type.

The system eliminates dividends from the beneficiary’s accounts based on the declaration made by the payer (held subsidiaries) in the Dividends account. Since the system removes them from the P&L, it also deducts them from retained earnings at the dividend flow and reduces the related investment.

Unlike Dividends payables and Dividends Receivables, which are subject to same logic of Intercompany Balance Sheet Eliminations, the Dividends Received or paid require elimination from P&L and subsequent treatment in Balance sheet.

We grouped SIE, dividends payables, and the hedging reserve under “Additional Eliminations” because their treatment can vary in the source system. Sometimes, the source system does not record SIE, and the user does not need to enter it.

In the next blog, I will discuss the automated adjustments that apply to the entities designated an Equity method of Consolidation through the ownership manager.