In the prior blog, I described in detail the automated elimination of investment and the treatment of equity accounts, along with the declaration of NCI and additional eliminations, between the holding company and its subsidiaries, under the same scope. In this part of the blog, I will describe how the Cloud Consolidation Extension for SAP Analytics Cloud will treat the associates/affiliates that are assigned the Equity Method in the ownership manager. Read on to learn how to achieve automated eliminations & adjustments.

Equity Method of Consolidation

This method of consolidation applies when the holding company has significant influence over the affiliate or associate (investee) within the scope. It does not require full control. It is generally used when ownership ranges between 20% and 50%.

For example, E1 Subsidiary – United Kingdom owns 40% of E7 Subsidiary France 2 under Scope 2.

E0 – Holding Germany owns 90% of E1 Subsidiary – United Kingdom under Scope 1. Therefore, E0 indirectly owns 36% of France 2 under Scope 1.

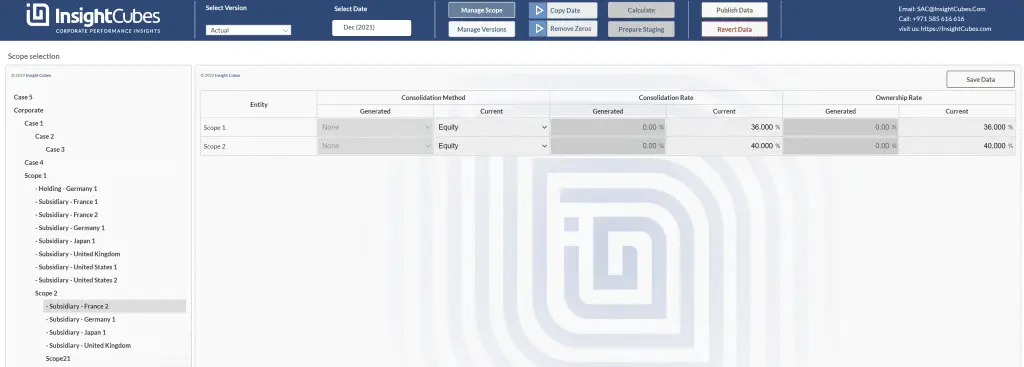

Ownership Manager Interface

The screenshot below shows the Ownership Manager interface with France 2 selected. The Analytic application will show the scopes that the selected entity belongs to. (by selecting a scope, it shows the entities under the scope, and by selecting an entity, it shows the scopes the entity belongs to. The Ownership Manager interface covers this.)

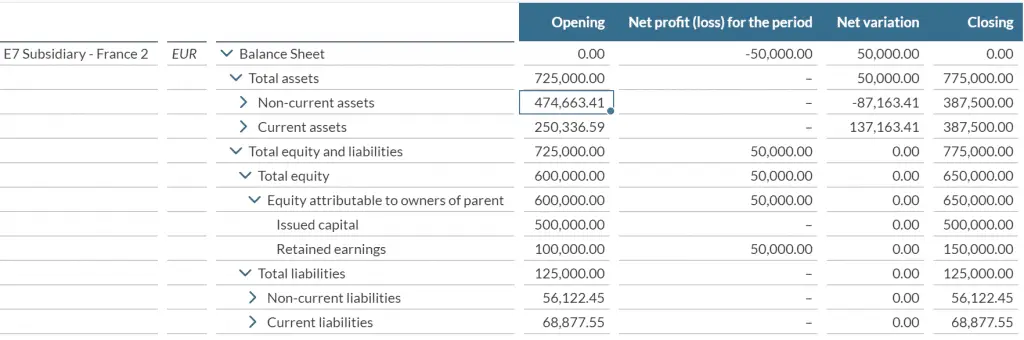

France 2 has the following values in its Balance sheet (on standalone level, EUR as local currency). The system calculates the net variation as opening plus movements minus closing. It derives the net profit (loss) for the period from the P&L.

Below is the standalone balance sheet of France 2 in Euro (local currency)

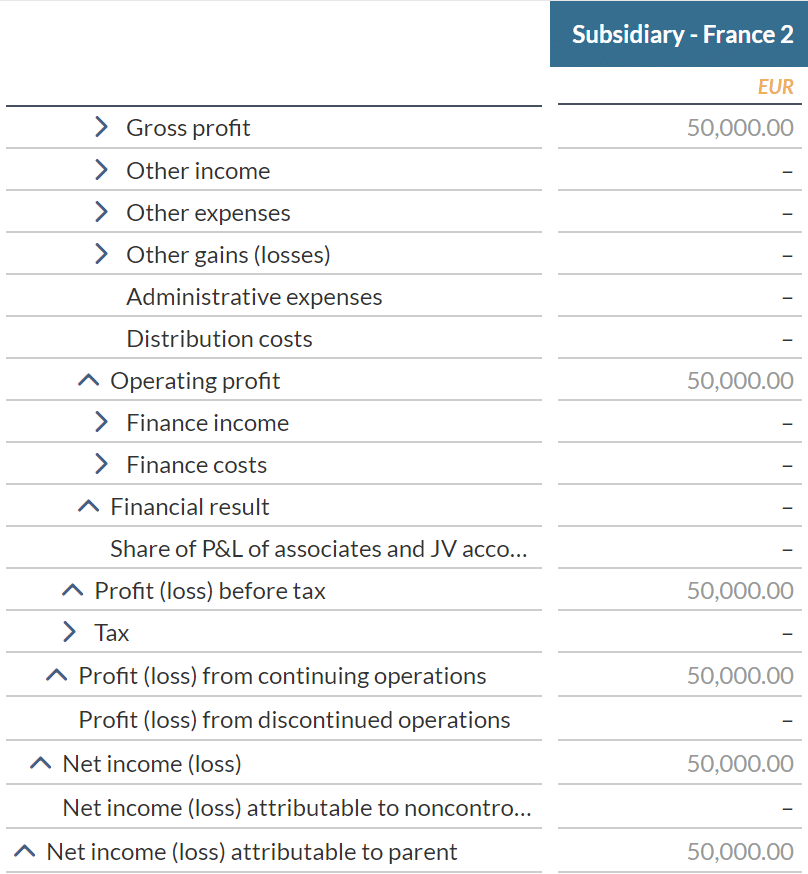

Below is the standalone profit and loss of France 2 in Euro (local currency)

Initial Investment and Currency Conversion

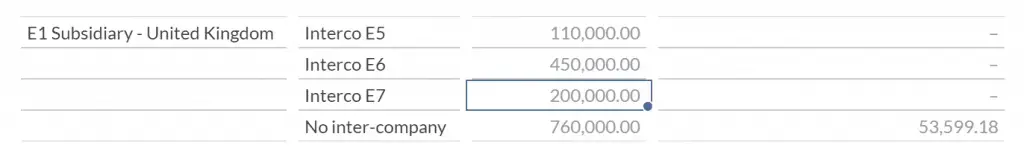

E1 Subsidiary – United Kingdom had an initial investment of 200,000 GBP in in E7 France 2 (which is equivalent to 236,206.90 EUR based on the currency conversion rules and the applicable closing rates, done by the Rate Model)

Consolidation under Scope 1

Since E0 owns 90% of E1, and E1 owns 40% of E7, E0 indirectly owns 36% of E7.

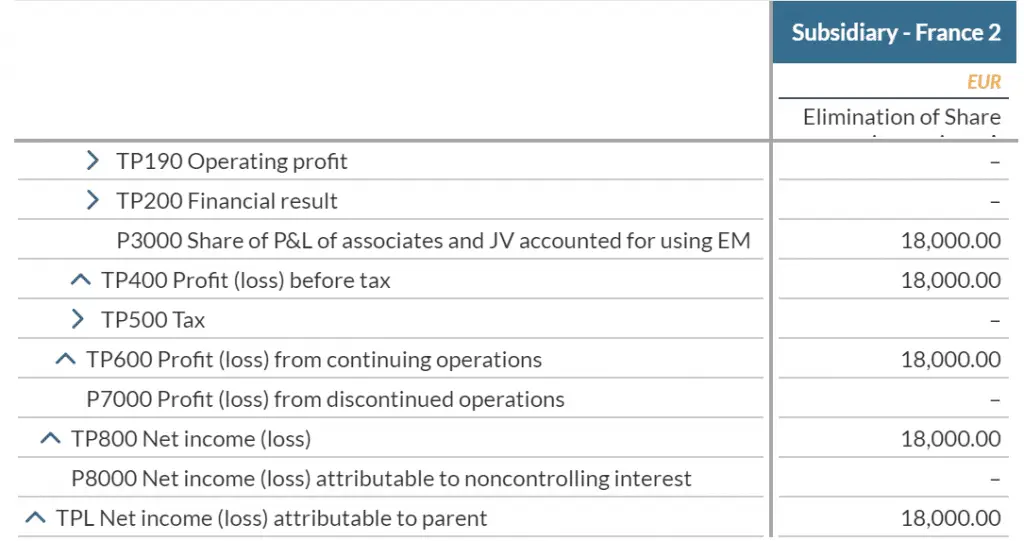

Consolidated P&L for E7 under Scope 1:

36% × 50,000 EUR = 18,000 EUR

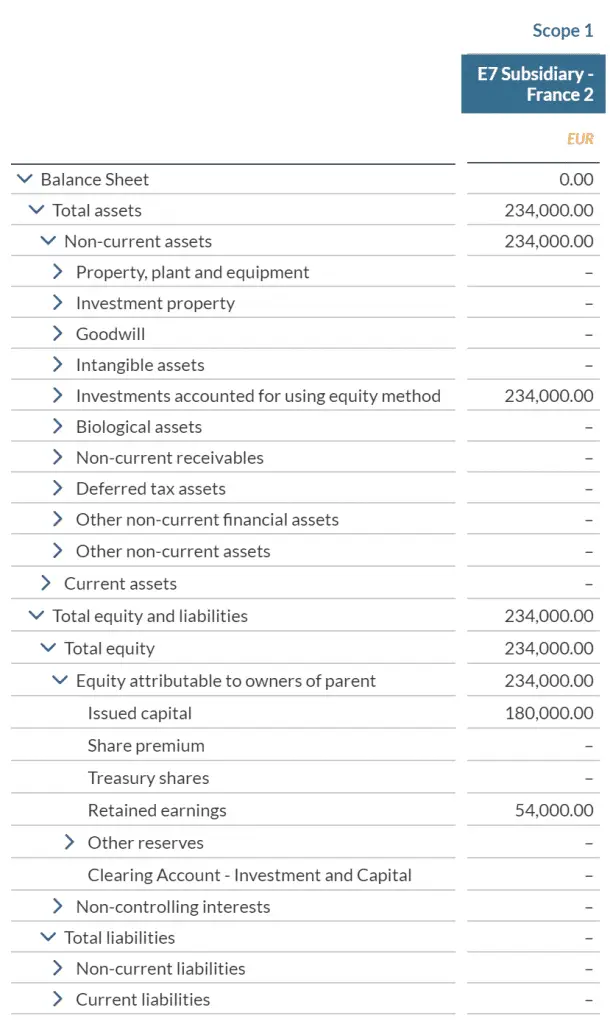

Balance Sheet Values:

The scenario demonstrates one method of consolidation where the customer requires a consolidated balance sheet for the equity-accounted company.

This method calculates the portion of retained earnings based on the ownership percentage.

An alternative approach creates a balanced consolidated statement for the equity-accounted company.

The initial investment by E2 of 200,000 GBP (236,206.90 EUR) became 234,000 EUR. The investment was revalued based on the ownership percentage from specific equity accounts and the portion of net income attributable to the parent (18,000 EUR)

Note: The standard equity method of consolidation does not perform this revaluation.

However, the Consolidation Extension provides it as an alternative logic.

Consolidation under Scope 2

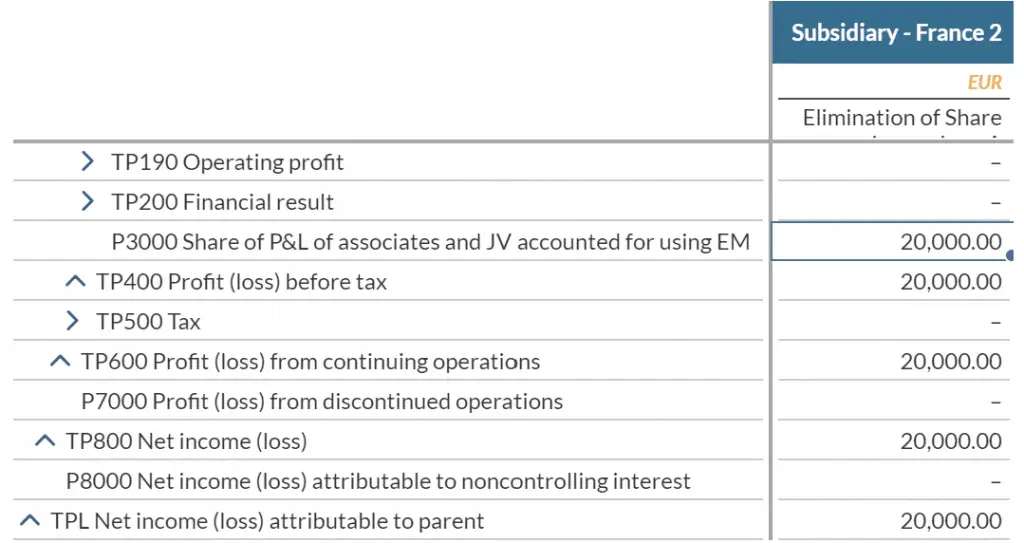

Consolidated P&L for E7 under Scope 2:

40% × 50,000 EUR = 20,000 EUR

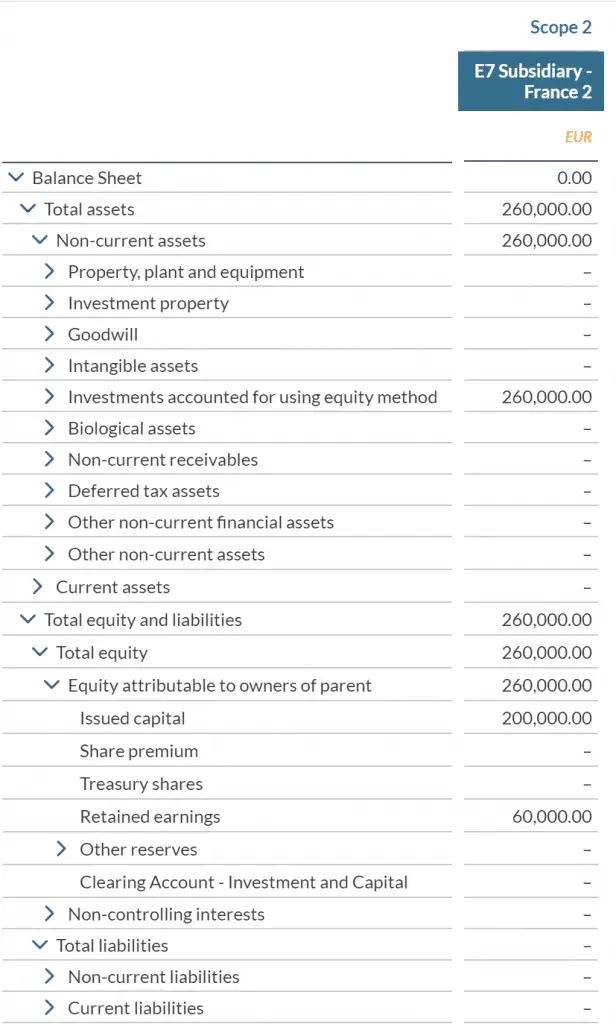

Balance Sheet Values:

This method of Equity Consolidation retains the portion of Equity owned by the holding and revalues the investment by generating the balancing value on investment accounted for using equity method. An alternative method which picks up the portion of equity from affiliate and revalues the investment in holding is also available and can be added to the logic (more will be discussed in the blog on How to customize logic)

Next Steps

In the next blog, I will additionally discuss the equity pickup method and the proportionate method of consolidation, also part of the Cloud Consolidation Extension for SAP Analytics Cloud.

You can also learn more about Intercompany Matching here.