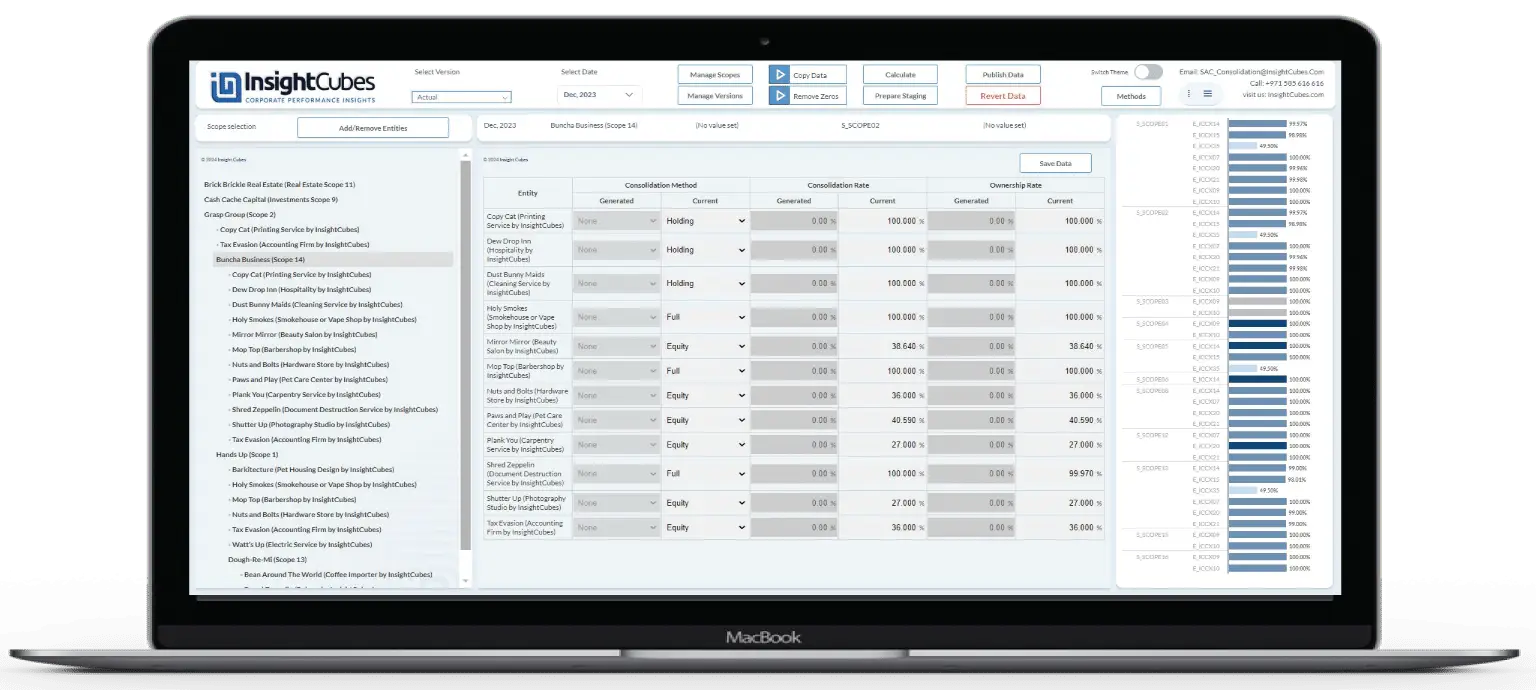

In a prior blog series, I discussed how the Cloud Consolidation Extension for SAP Analytics Cloud conducts detailed currency conversion and automates the eliminations through the consolidation process. The automated eliminations were covered in a series of blogs (blog 1, blog 2, blog 3, blog 4) and subsequent blogs regarding scope and ownership changes, in addition to the staging method of consolidation will be posted.

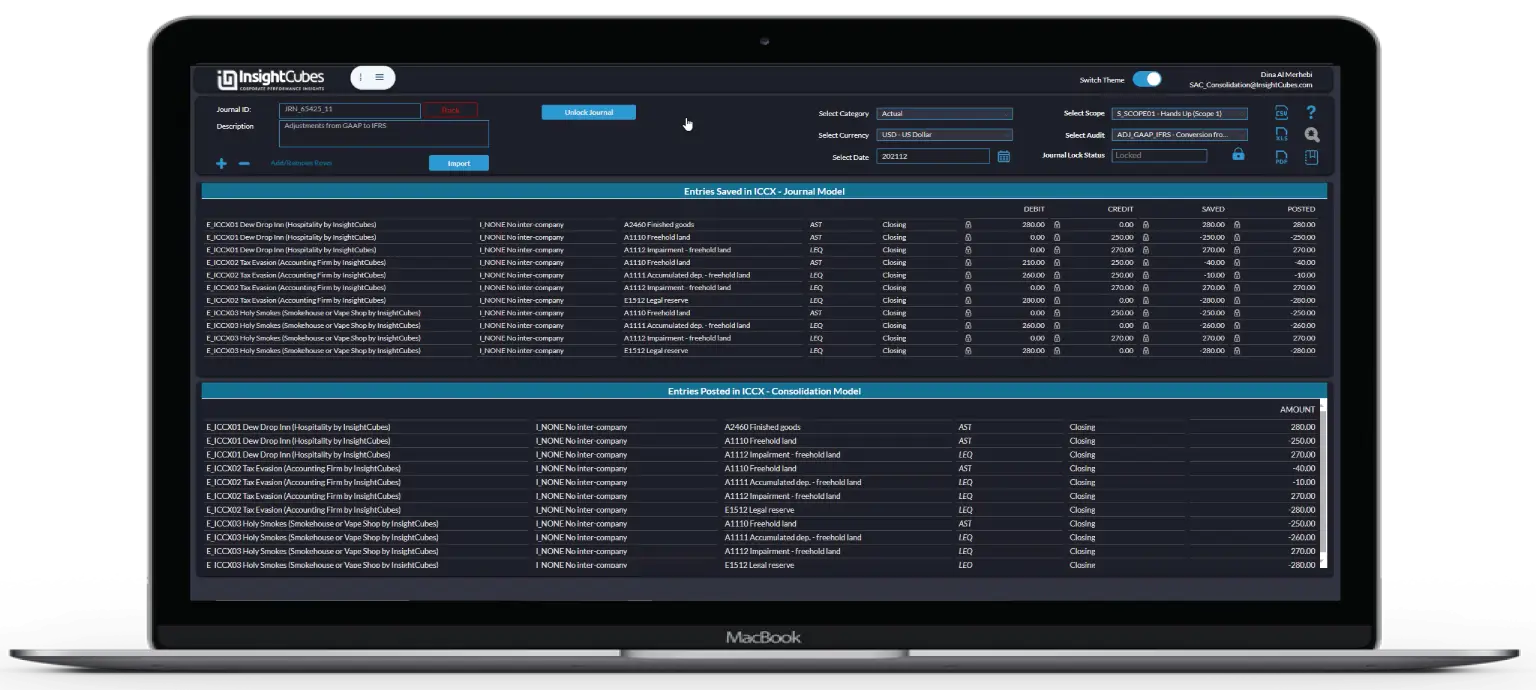

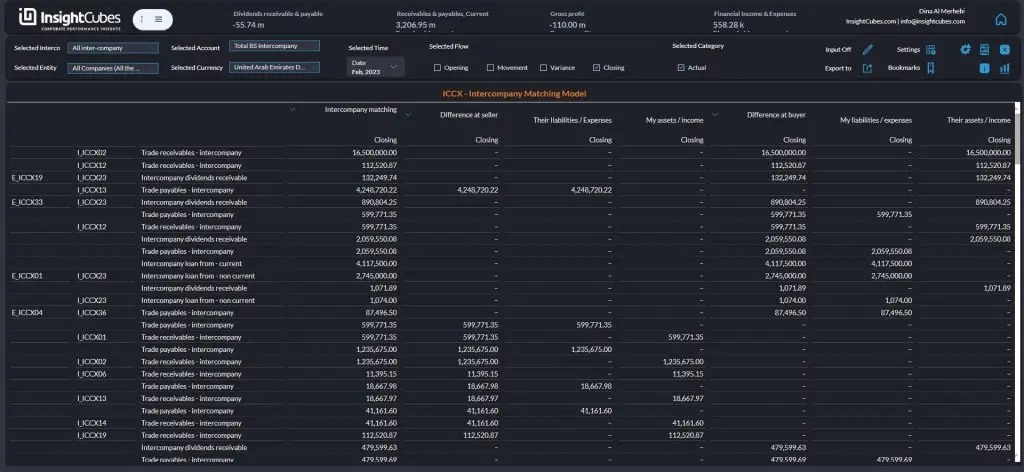

However, in this blog post, I will be describing the process of Intercompany Matching and booking, which can be executed before and/or after the consolidation process (basically, after loading the standalone data into the Cloud Consolidation model on SAP Analytics Cloud)

The purpose of the Intercompany matching model is to enable the group companies to reconcile their intercompany transactions among themselves, by checking what has been booked against them by their partners and comparing it to their own books. In other words, SAP Intercompany Matching model provides the group companies with the visibility to reconcile their intercompany transactions against the values booked against them by their partner companies.

For example, entity A records a receivable of 100 USD from entity B, in turn, entity B should records a payable of 100 USD to entity A. If this is the case, the Consolidation model will eliminate the values and there would not be any residual value between the two companies. However, this might not always be the case. Company B might miss to record the payable amount or might record a different amount.

In the Consolidation Model, neither Entity A nor Entity B can see what has been recorded against either one of them by their partners (unless the same user has data access to both these companies). To ensure that Entity A can see what has been booked against it by Entity B and vise versa, we transfer the values to the IC Matching Model using a logic, which allocates the Intercompany Transactions booked by all the partners against the Entity under “Their Liabilities/Expenses” and “Their Assets/Income”.

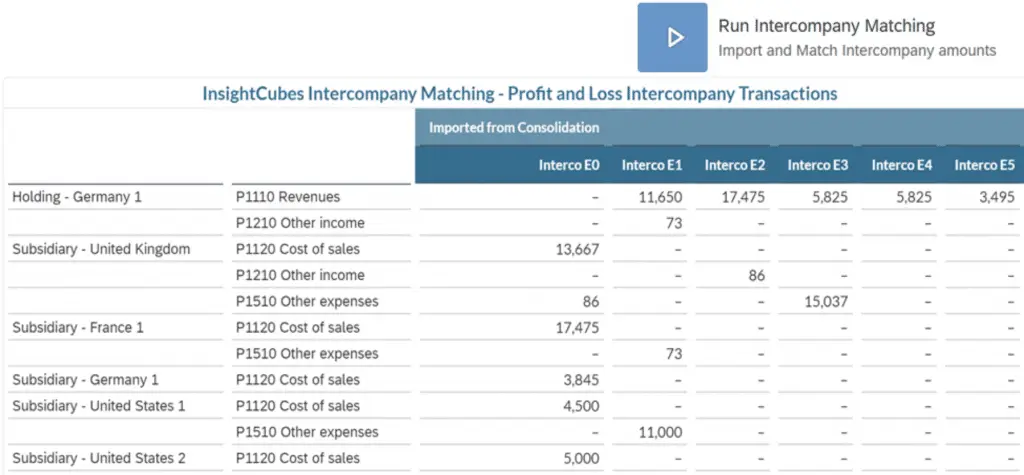

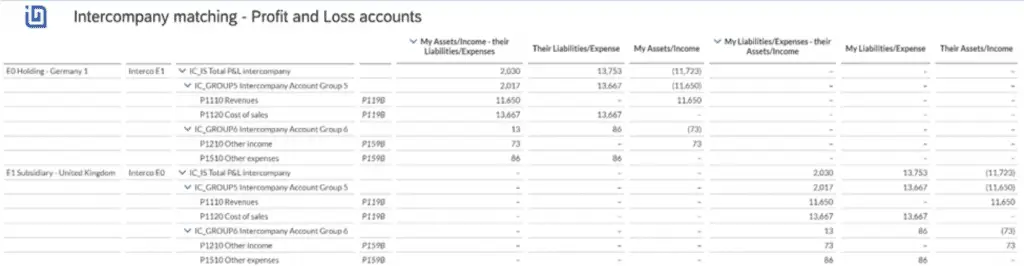

To make this relevant, lets consider the following Scenario, as depicted in below screenshot:

E0 has the following intercompany transactions with E1

- Revenues: 10,000

- Other Income: 62.56

Meanwhile, E1 recorded the following intercompany transactions with E0

- Cost of Sale: 9,998

- Other Expenses: 62.56

Needless to say, the employee in E0 cannot see the values in E1, and vise versa. Last, the local currency of E0 is Euro (EUR), as for E1, it’s local currency is British Pounds (GBP).

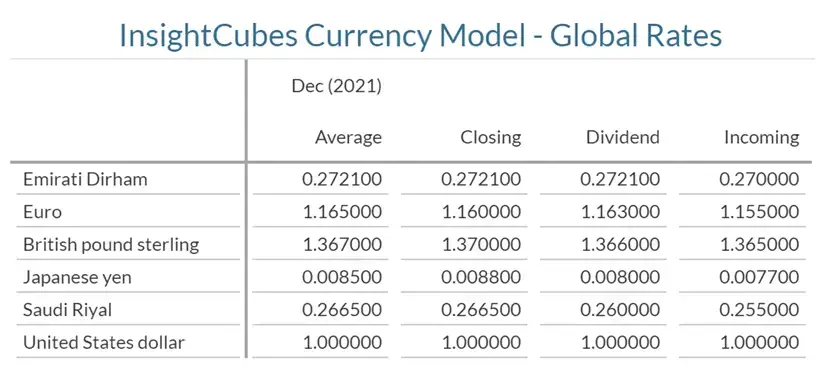

The currency conversion rates, as of the month of these transactions, are as below (Detailed explanation of the comprehensive currency conversion can be seen in this blog

Once the user clicks on Run Intercompany Matching, the system will convert the values from the local currencies of their respective entities to the multiple desired reporting currencies, and push these converted values into the IC Matching Model on specific Audit Trail members, using a sequence of logic to allocate and book differences.

In the above screenshot, we see that the converted values have been imported to the IC Matching Model on an audit Trail Member called “Imported from Consolidation”. The values are being shown in USD, but any reporting currency can be used. E0 had 10,000 EUR (its local currency) of Revenues from E1, this amount is now showing as 11,650 USD (Eur Conversion rate for Average is 1.65 to the dollar). Meanwhile E1 had 9,998 GBP (E1’s local currency) of Cost of Sales from E0, this amount is now showing as 13,667 USD (GBP conversion rate for Average is 1.367 to the dollar).

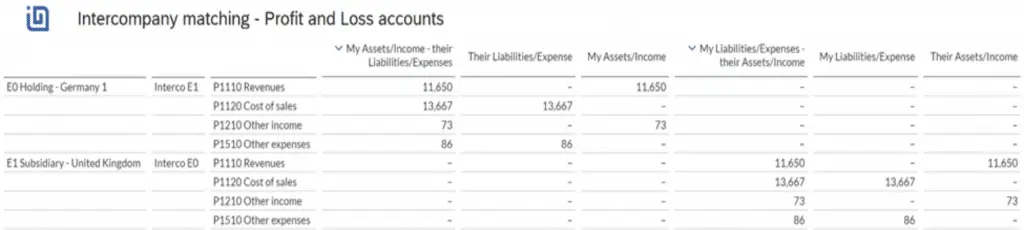

The subsequent step in the logic is to allocate the values in a way that allows the user from E0 to see what has been booked against them by their partner companies and reconcile the differences, if any. In the below screenshot, we can see that the COGS intercompany transaction in E1’s books against E0 is now showing in E0 books under “Their Liabilities/Expense” for the value of 13,667 USD, meanwhile the Intercompany Revenue which was originally in E0’s books against E1 is showing under My Assets/Income.

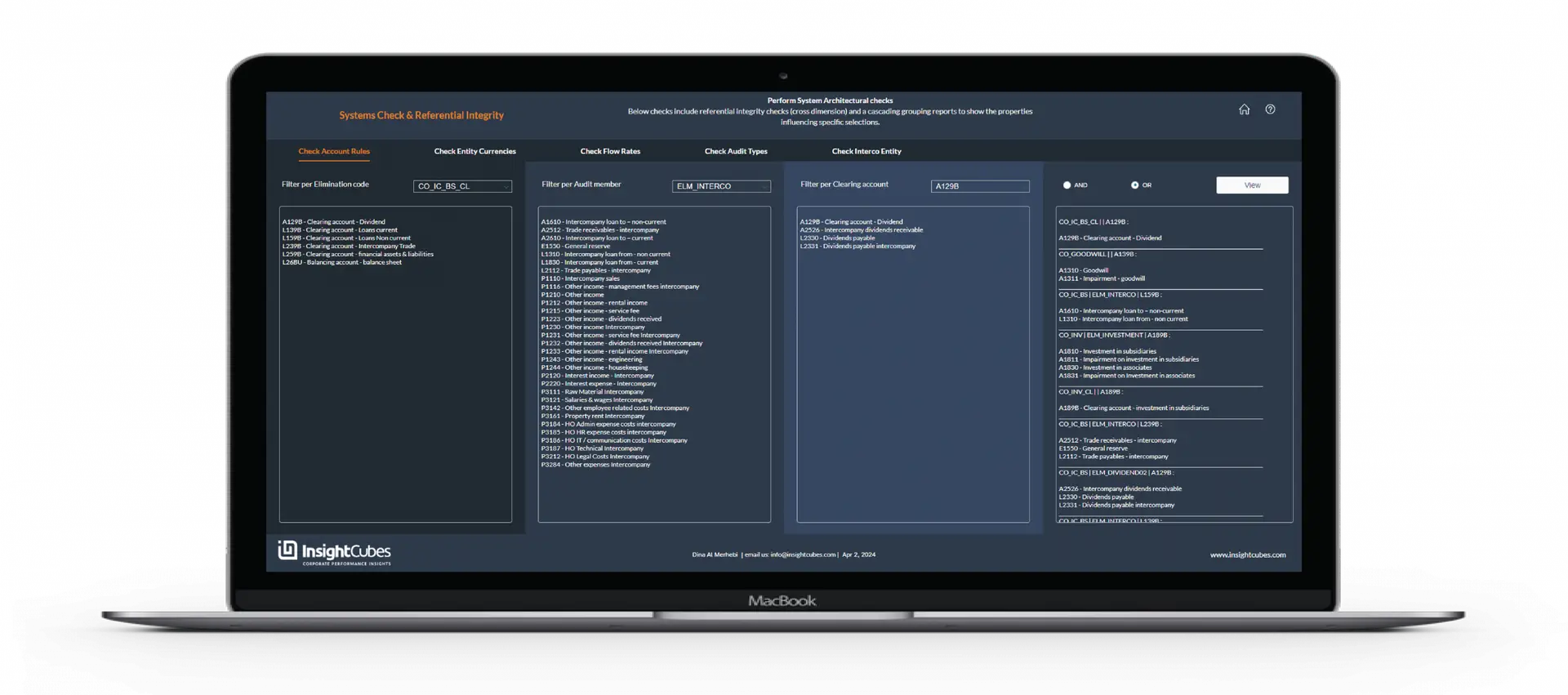

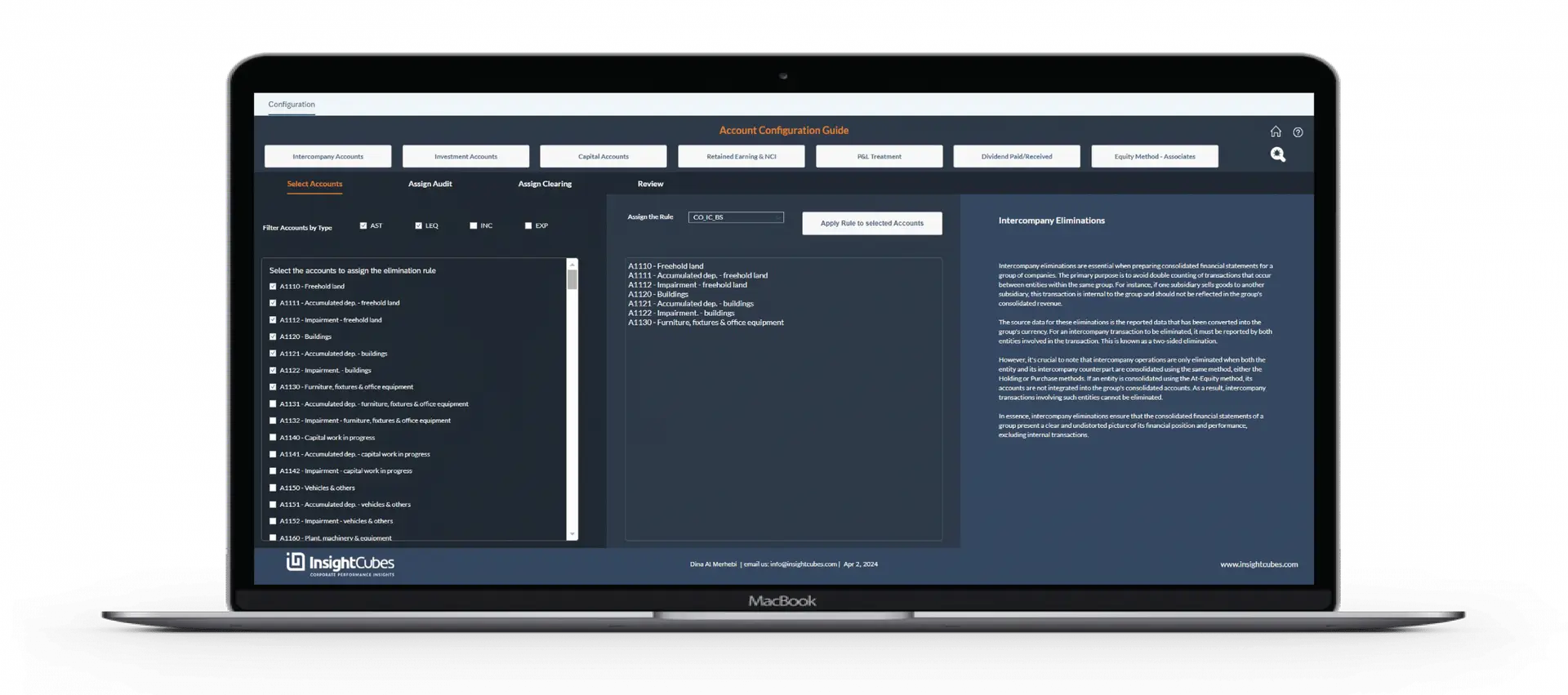

As shown in the Intercompany Elimination, we group a set of intercompany accounts with clearing accounts. Revenue and Cost of Sales have the same clearing account P119B. This account would have shown differences in the consolidation model if the intercompany elimination was triggered. By grouping Revenues and Cost of Sales under a parent named “IC_GROUP 5”, we see that 2,017 USD is the difference between what was recorded by E1 towards E0 as Cost of Sales, and what E0 recorded against E1 as Revenue.

If you look at the value 13,667 USD, you will find it under “Their Liabilities/Expense” for E0, and you will also see it under “My Liabilities/Expense” for E1. This allocation logic from the consolidation model to the Intercompany matching Model provides the full visibility for the group companies to reconcile their differences by seeing exactly what their partners have booked against them, and match it with their books.

The last step is to book the differences to the seller, buyer or greater using another audit trail member called IC_Difference. This is achieved by assigning an attribute value to a set of intercompany accounts with same clearing account (or their parent account) to designate the method of booking the difference (Seller, buyer, greater)

There you have it – now you should know how to perform SAP intercompany matching with our software.