In the prior blog, I described in detail the automated elimination of investment and the treatment of equity accounts, along with the declaration of NCI and additional eliminations, between the holding company and its subsidiaries, under the same scope. In this part of the blog, I will describe how the Cloud Consolidation Extension for SAP Analytics Cloud will treat the associates/affiliates that are assigned the Equity Method in the ownership manager. Read on to learn how to achieve automated eliminations & adjustments.

Equity Method of Consolidation

This method of consolidation is used when the holding company has significant influence over the Affiliate/Associate company (investee) within the scope but does not exercise full control over it.

Generally used when ownership is less than 50% and higher than 20%.

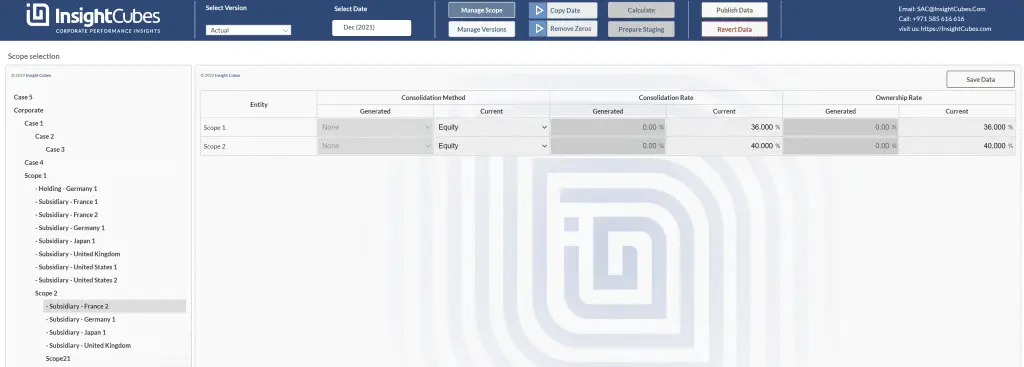

E7 Subsidiary France 2 is owned by E1 Subsidiary – United Kingdom under Scope 2 by 40%.

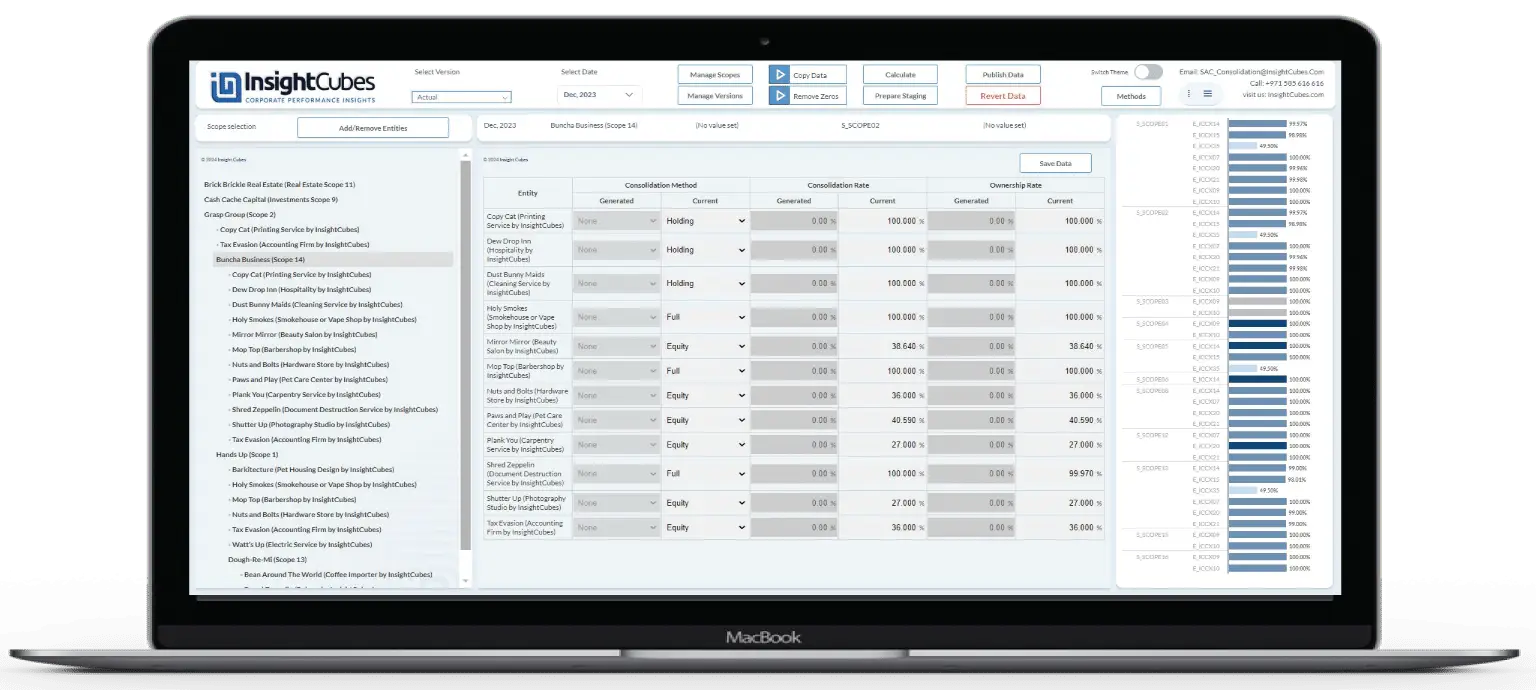

E0 – Holding Germany owns E1 Subsidiary – United Kingdom by 90% under Scope 1, so E0 indirectly owns France 2 by 36% under Scope 1. Below is a screenshot from the ownership Manager interface with France 2 Selected. The Analytic application will show the scopes that the selected entity belongs to. (by selecting a scope, it shows the entities under the scope, and by selecting an entity, it shows the scopes the entity belongs to. This is covered in the ownership manager interface)

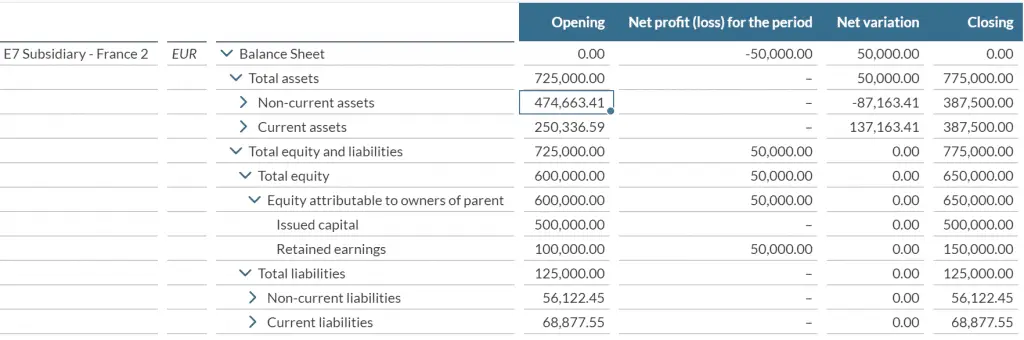

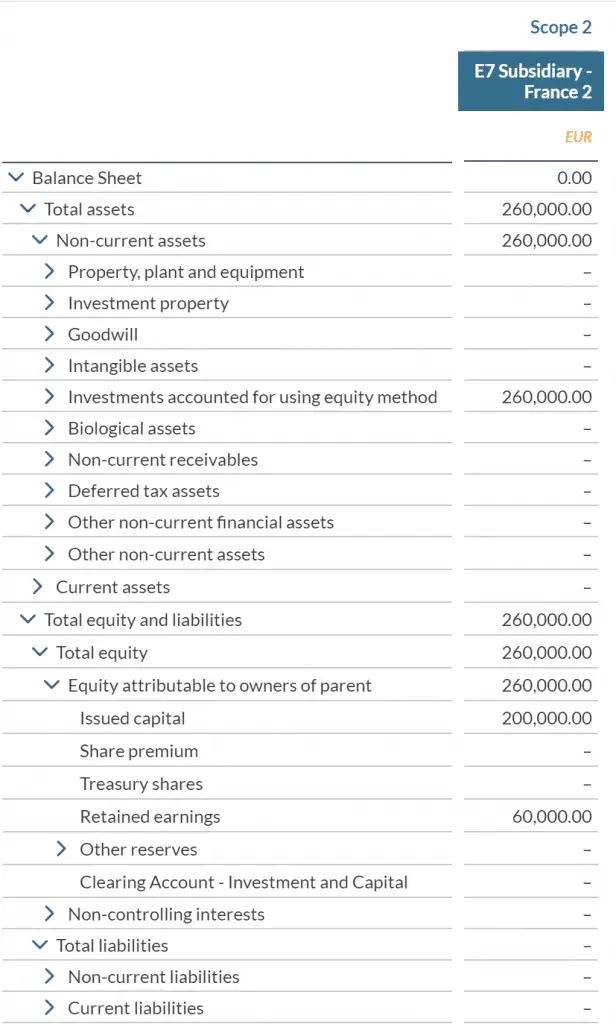

France 2 has the following values in its Balance sheet (on standalone level, EUR as local currency). The net Variation is calculated by the system based on opening + movements – closing. The Net profit (loss) for the period is acquired from the P&L.

Below is the standalone balance sheet of France 2 in Euro (local currency)

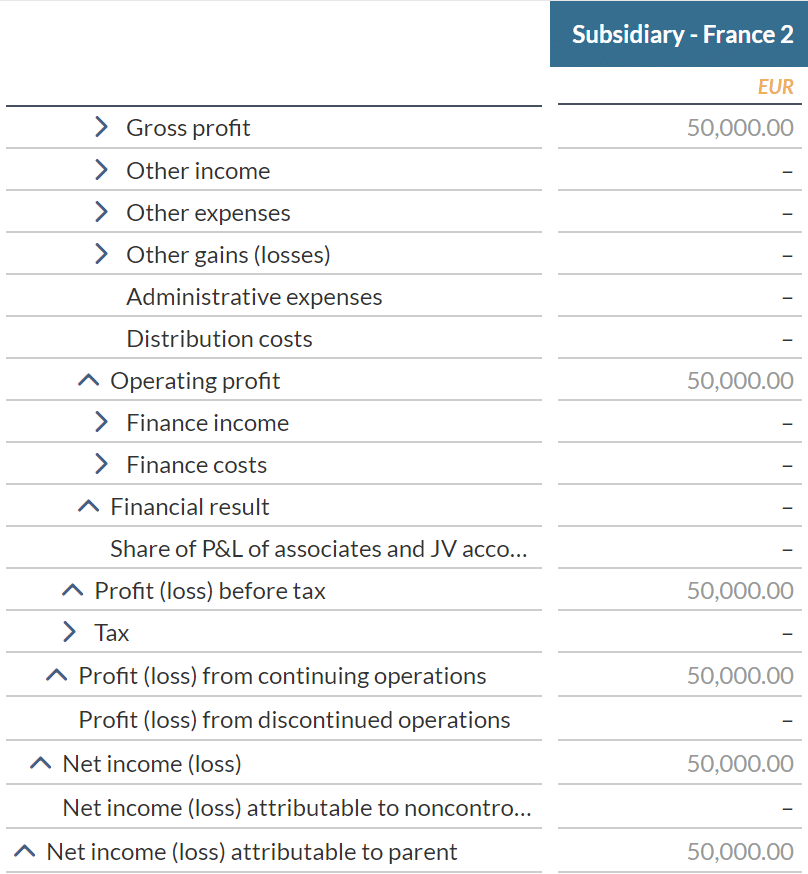

Below is the standalone profit and loss of France 2 in Euro (local currency)

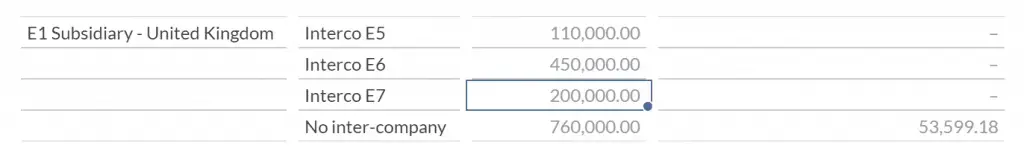

E1 Subsidiary – United Kingdom had an initial investment of 200,000 GBP in in E7 France 2 (which is equivalent to 236,206.90 EUR based on the currency conversion rules and the applicable closing rates, done by the Rate Model)

Under Scope 1, Since E0 owns 90% of E1, and E1 owns 40% of E7, then E1 indirectly owns 36% of E7.

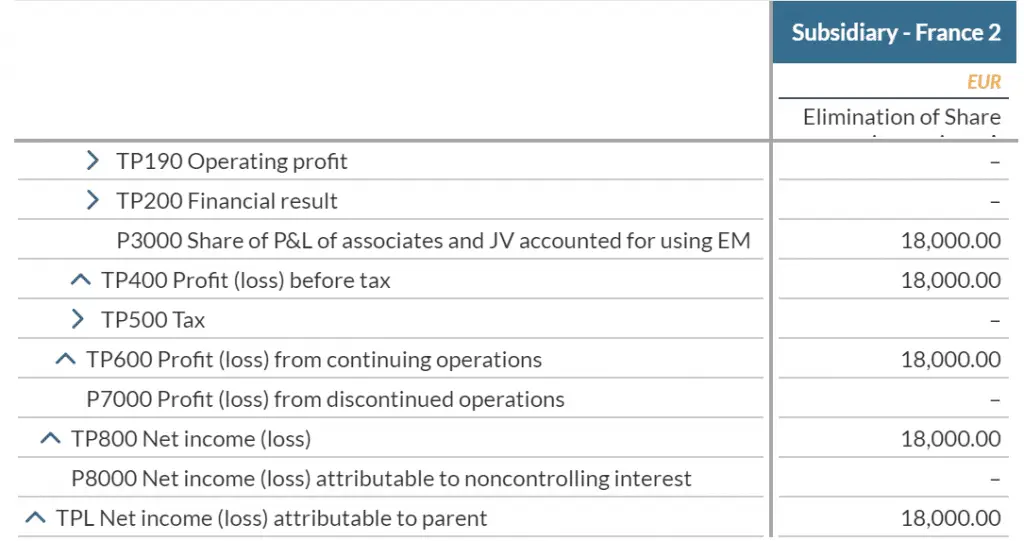

When we run the consolidation for Scope 1, we will have the following Consolidated P&L for E7.

36% * 50,000 Euro = 18,000 EUR under Scope 1

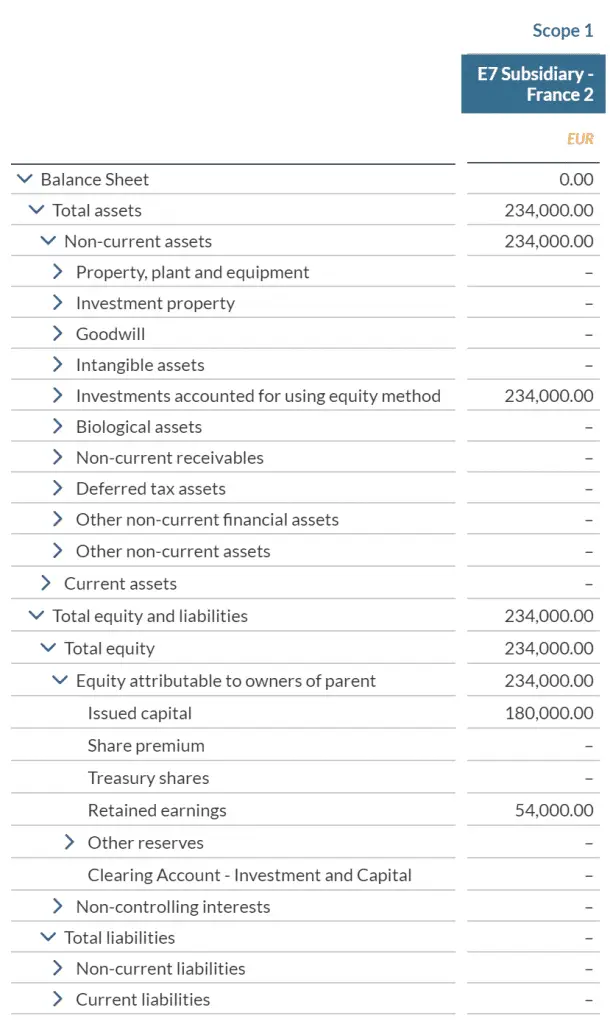

The balance sheet will have the following values. In this scenario, we are doing one method of consolidation whereas the customer needs have a consolidated balance sheet for the equity accounted company.

It is a derivation to the standard, which only picks the portion of retained earnings equivalent to our ownership percentage. This alternative method will generate a balancing consolidated financial statement for the equity accounted company.

The initial investment by E2 of 200,000 GBP (236,206.90 EUR) became 234,000 EUR. The investment was revalued based on the ownership percentage from specific equity accounts and the portion of net income attributable to the parent (18,000 EUR)

The standard equity method of consolidation would not do that, but is also part of the Consolidation Extension as an alternative logic.

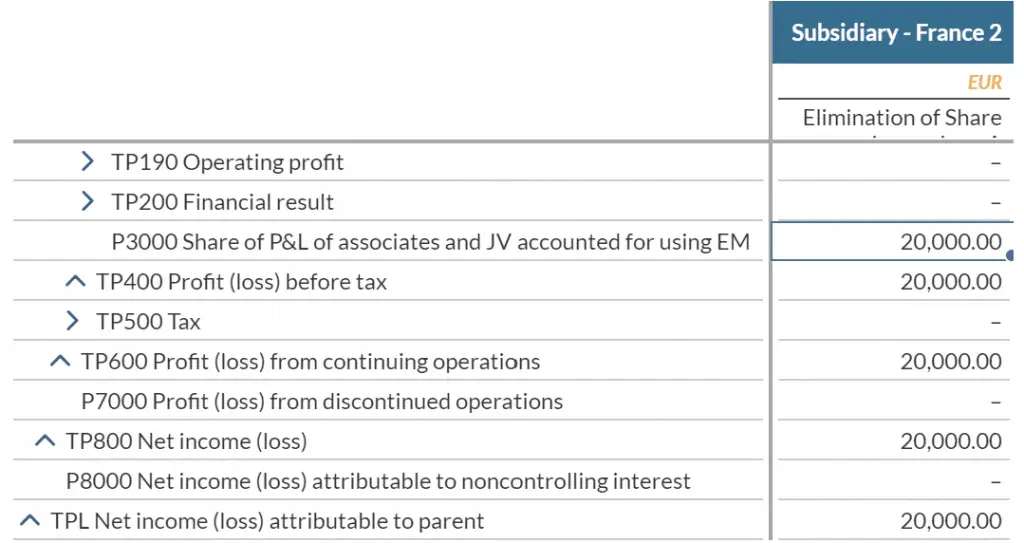

And under Scope 2, the consolidated P&L of E7 will have the following values

40% * 50,000 Euro = 20,000 EUR under Scope 2

The balance sheet will have the following values

This method of Equity Consolidation retains the portion of Equity owned by the holding and revalues the investment by generating the balancing value on investment accounted for using equity method. An alternative method which picks up the portion of equity from affiliate and revalues the investment in holding is also available and can be added to the logic (more will be discussed in the blog on How to customize logic)

In the next blog, I will discuss the equity pickup method and the proportionate method of consolidation which are also part of the Cloud Consolidation Extension for SAP Analytics Cloud.

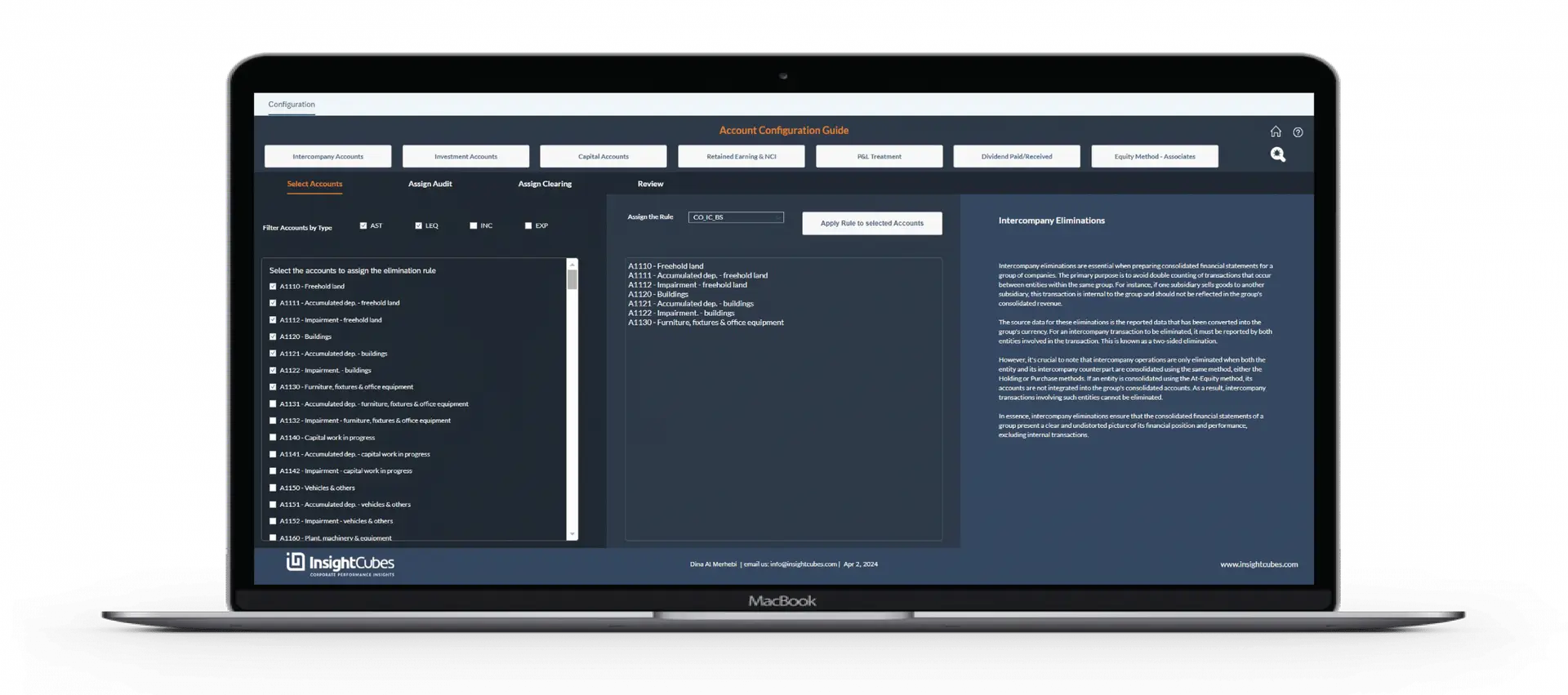

You can also learn more about Intercompany Matching here.