InsightCubes Cloud Consolidation for SAP Analytics Cloud®

A comprehensive consolidation solution that runs natively on SAP Analytics Cloud®

The InsightCubes Cloud Consolidation is a set of models with advanced formulas & calculations, custom widgets and Dashboards designed to automate comprehensive IFRS/GAAP consolidation on SAP Analytics Cloud. The solution is prebuilt with detailed currency conversion rules, consolidation methods and eliminations that will convert standalone financial statements into IFRS compliant consolidated financial statement. InsightCubes Cloud Consolidation is an end to end solution, with a centralized Consolidation Cockpit interface that includes multiple dashboard covering Ownership management, journal adjustments, consolidation monitor, workflow, work status, and end to end financial reporting.

Cloud Consolidation Model

- Detailed Currency conversion to include opening, incoming, dividend, closing, historical and CTA (global and entity specific rates)

- Custom third-party widgets to enable the Ownership & journal interface, overcoming current SAP Analytics Cloud limitations

- Multiple scopes and methods of consolidation (Holding, full, and equity)

- Matrix, Staging and roll up methods of consolidation

- Scope change treatment

- Intercompany elimination of any group of accounts

- Elimination of dividends, Shares in earning treatment, investment, capital, share and Declaration of non controlling interest for subsidiaries

- Equity pickup rules for affiliates

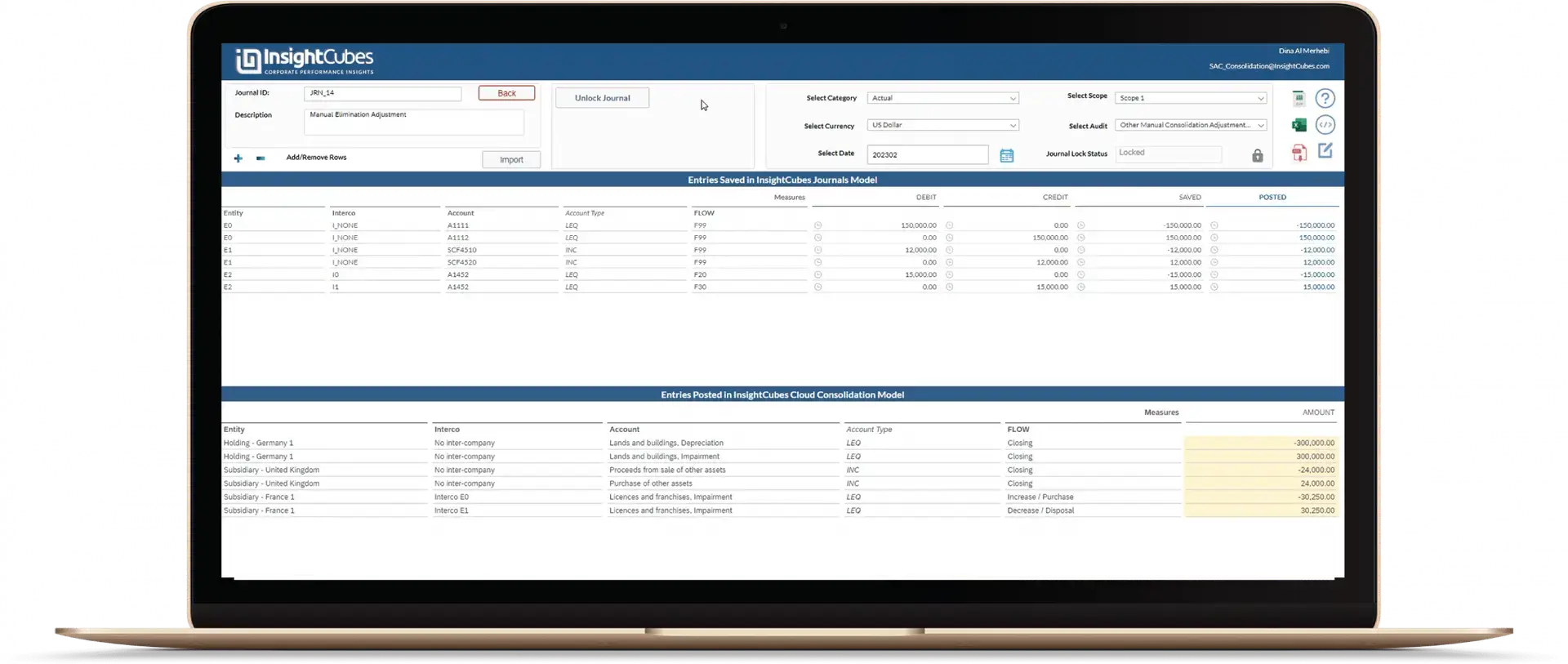

- Journal interface with debit/credit posting and parking features

- Interactive dashboards and EPM style analytic application through a unified Web Cockpit using analytic application

- Scalable deployment: Leveraging on the capabilities of Advanced Formula, additional logic can be sequenced after the “Baseline” logic to generate desired results.

- Multiple chains of Advanced formulas for different consolidation needs

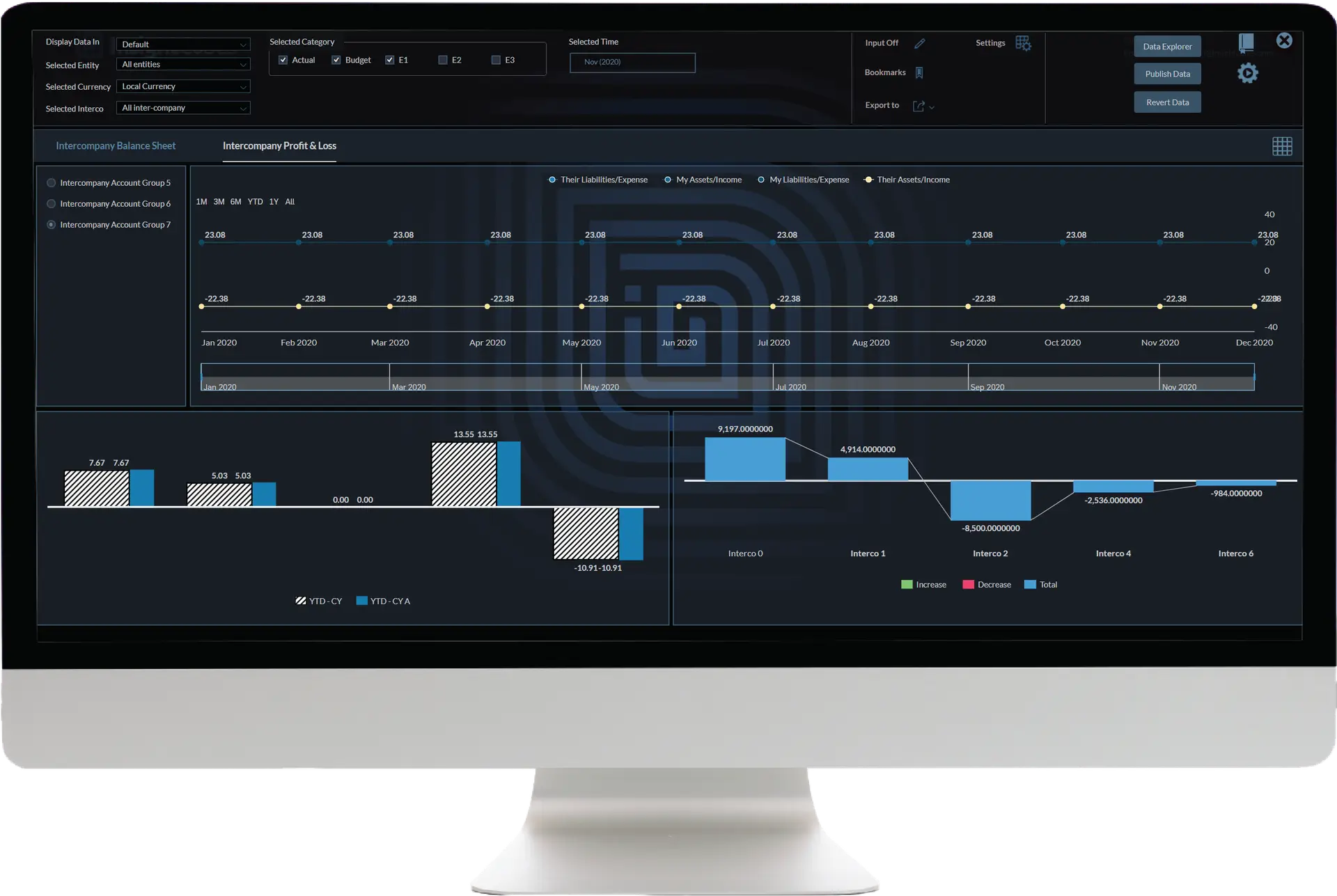

Intercompany Matching

Providing self service reconciliation to subsidiaries for faster close

The Intercompany matching model includes a set of Advanced formulas, Data packages, Dashboards and stories that enables reconciliation of intercompany transactions between subsidiaries without relying on Head Office.

The InsightCubes Intercompany Matching Model records the declarations and reported balances by other entities against a particular entity. It allows business users within each reporting entity to run a report that matches all of its declarations and reported balances against the balances of the rest of the entities, without having to assign to each owner read-access for other entities. Bookings that make the Intercompany declarations match are generated automatically, and details can be posted to the consolidation model.

The model is designed to easily match “their” books with “our” books.

However, the possibilities go beyond matching of intercompany account values:

- Products: Quantities delivered vs Quantities received

- Forecasts: Demand and supply

- Human Resourcing: Talent matching and secondment

- Production: Inventory items and production requirements.

The Intercompany matching model will include IC Booking logic based on Seller/Buyer/greater, to further provide familiar SAP BPC capabilities.

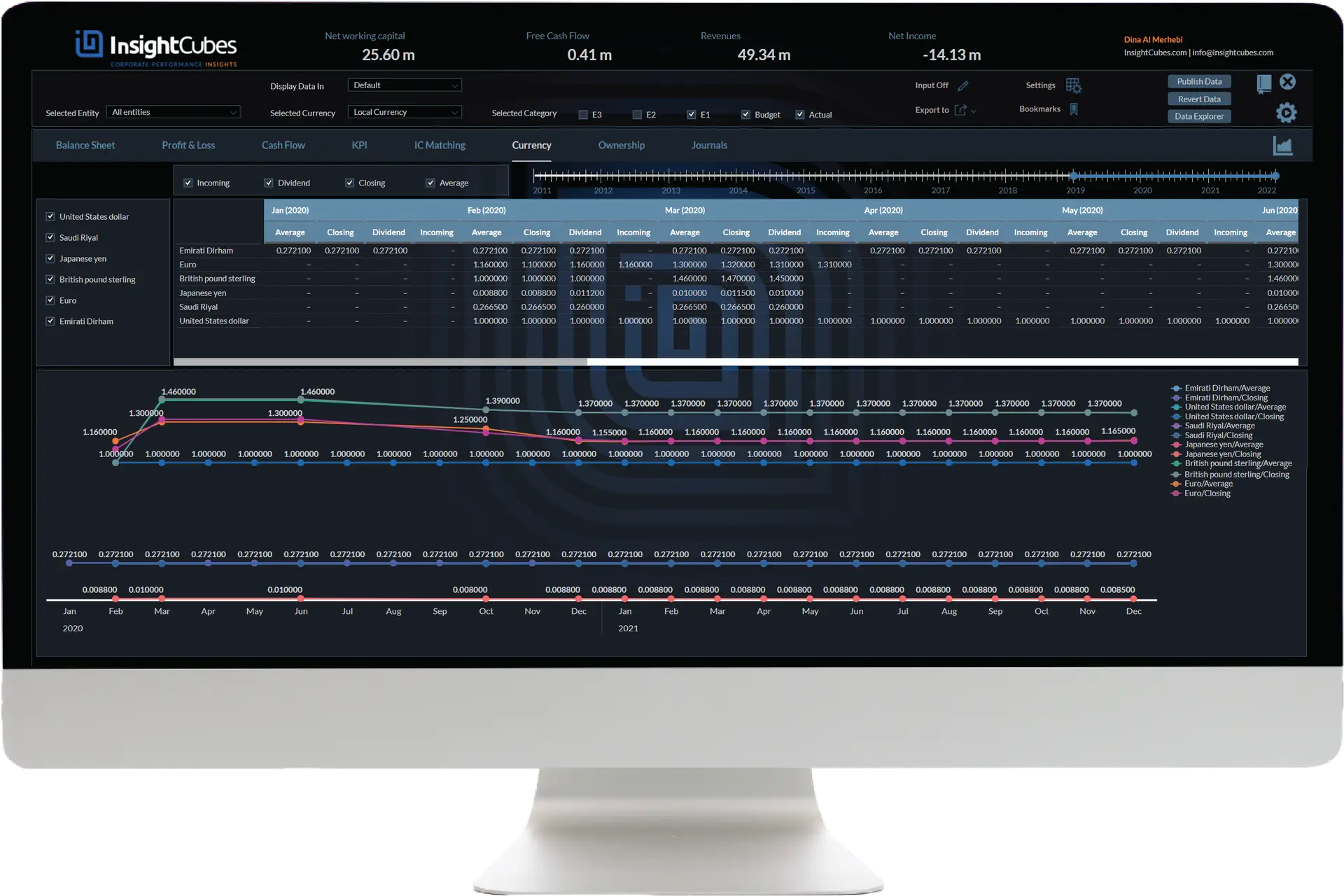

Currency Model

SAP Analytics Cloud does not provide detailed currency translation; the native currency translation considers closing and average, per account, but doesn’t allow translation of balance sheet movements. To extend the capabilities of SAC, a currency model is required to act as a driving model to the consolidation model, converting the financial statements for each company, per local currency, to the multiple reporting and group currencies.

- The currency model allows the creation and storage of different rates for any currency, and calculates the detailed movement of the financial statement.

- Add any currency (USD, EUR, SAR, AED) and define the rates (Closing, Dividend, Incoming, Historical)

- Assign the Rate to the Movement (Closing balance will be converted at closing rate, Dividend paid/received at dividend rate)

- Create global rates per currency or entity specific rates per currency

- Run currency translation to generate the currency converted values per account and movement, along with the CTA per each account.

No programing is required to run the currency conversion, even if new currencies and rates are being added. The system cross checks the Local Currency of the entity, fetches it from the currency model and begins to convert to the reporting currencies per individual rate. Opening Rates per currency are taken from last year closing rates, and CTA are calculated automatically.

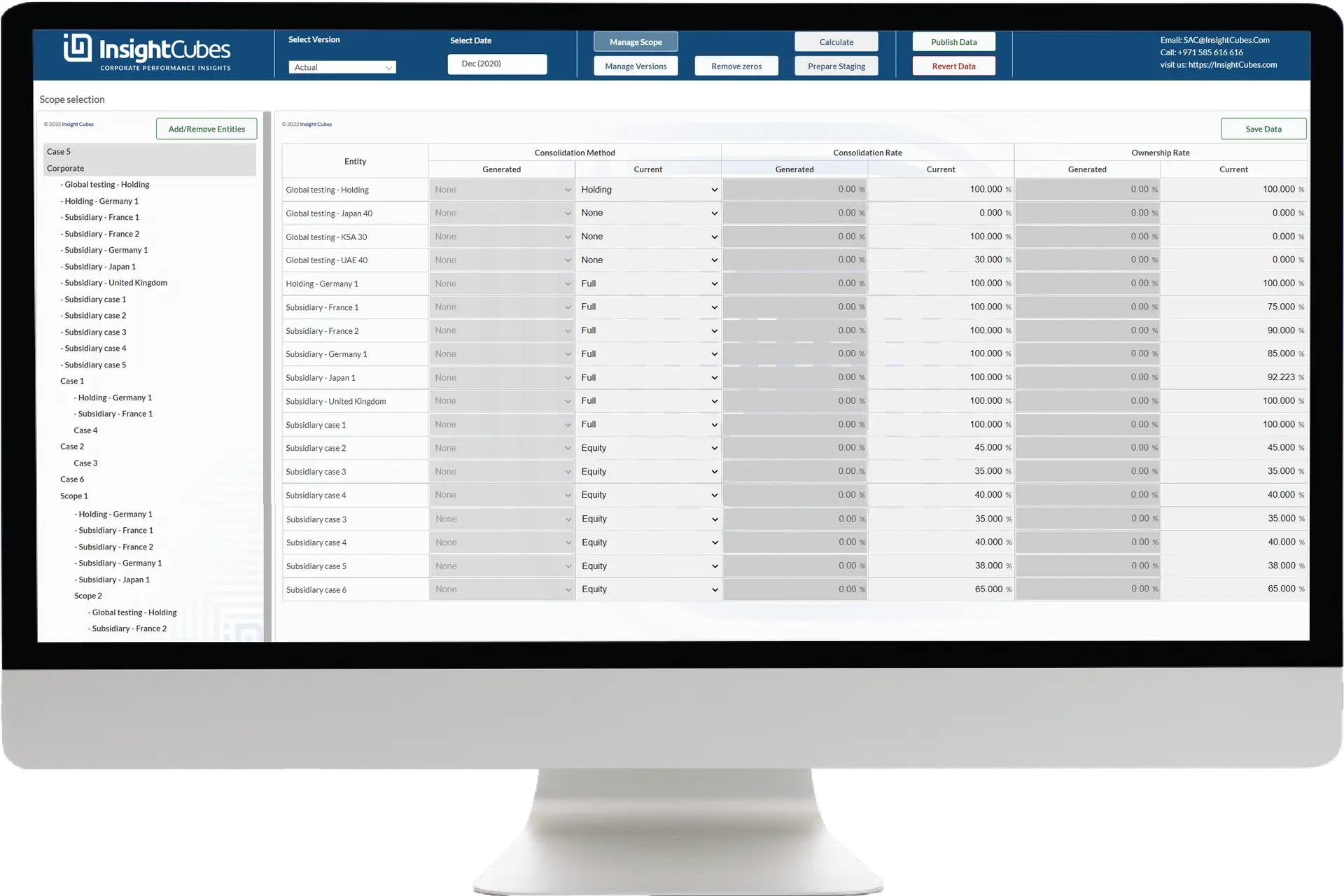

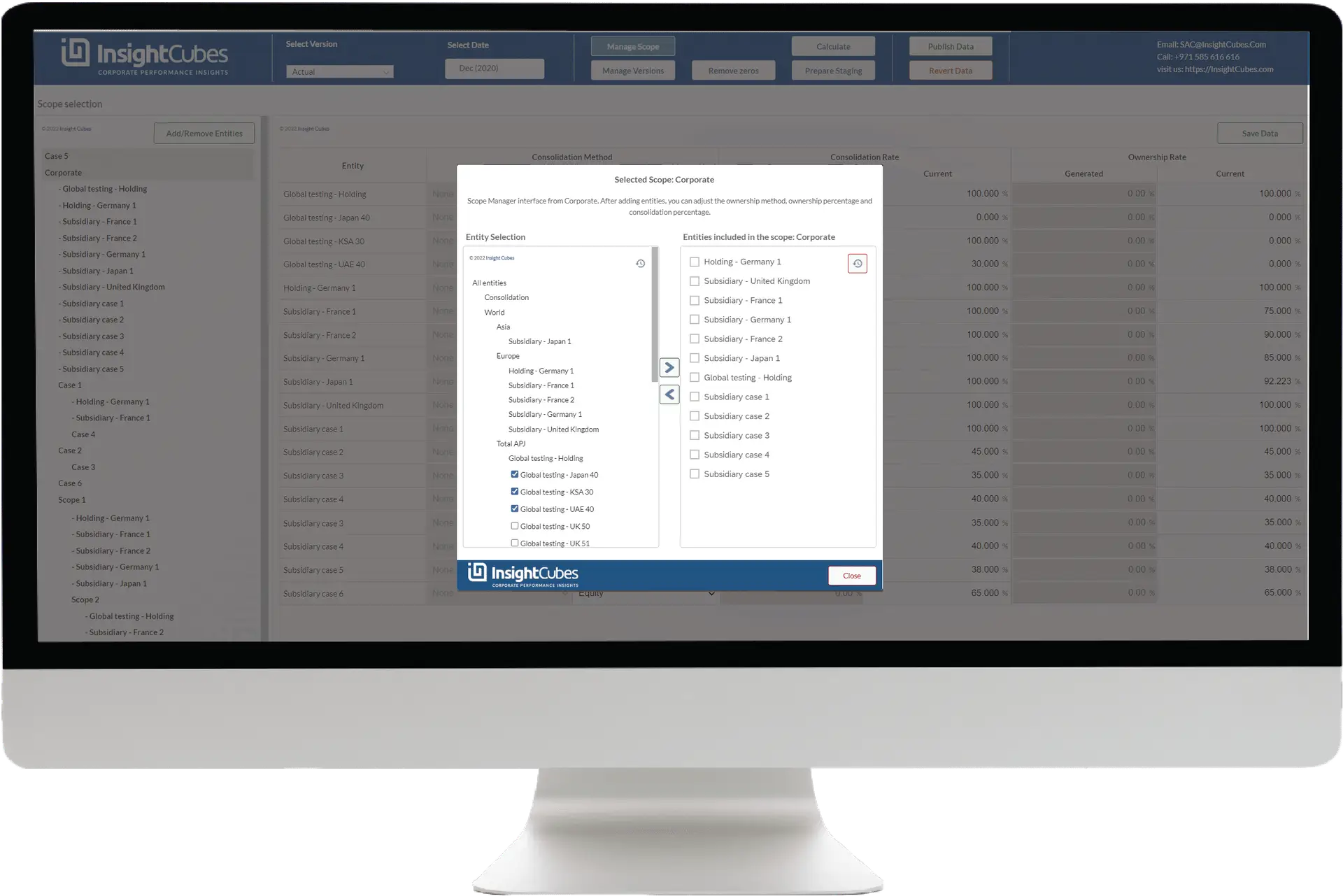

Ownership Structure

The ownership model is a driving model for the consolidation model

The model is designed to easily add Entities, with their Ownership, percentage, own methods and Consolidation percentage per Scope

- The table lists all the directly and indirectly owned entities under the selected scope. Meanwhile, the scope selection list shows the scopes and subscopes, in addition to the directly owned entities u der each scope.

- The Ownership Dashboard is composed of native and custom SAC widgets, increasing the native functionalities and features of SAC

- Allows users to enter percentage of consolidation, percentage of ownership and select methods of consolidation. Holding, full and equity.

- The ownership model is a driving model for the consolidation model.

- This interface allows users to add and remove entities from scopes.

- It also allows users to create new scopes and subscopes, assign group currencies and staging entities per scope.

Journals

Make any manual reclassification and adjustments to the standalone or consolidated financial statements by entering manual journals, whenever needed. The application allows parking the values in debit and credit form for approval, and posting the net values to the consolidation model.